The Miami County Auditor is responsible for maintaining accurate property records, ensuring fair taxation, and supporting transparent financial management throughout Miami County, Ohio. The office provides critical services for residents, homeowners, and businesses, including detailed property assessments, access to tax records, and oversight of financial transactions. By acting as the county’s tax authority and public records office, the Auditor ensures that all data is reliable, legally compliant, and easy to access. The office also supports community planning and real estate development by providing precise real estate assessment information. Accurate records and transparent reporting help maintain accountability and public trust across the county.

Matthew W. Gearhardt, the current Miami County Auditor, leads the office with a focus on efficiency, accuracy, and accessibility. The Auditor’s office works closely with the property assessment office to assign fair market values, manage tax collection processes, and maintain comprehensive public records. Residents can use the office to verify property ownership, calculate taxes, or apply for exemptions such as homestead relief. By providing modern digital tools and up-to-date records, the office helps homeowners, investors, and local officials make informed decisions. Its commitment to transparency and reliability strengthens confidence in local governance and ensures Miami County’s fiscal integrity is maintained.

Miami County Auditor Responsibilities

The Miami County Auditor ensures that all property and financial records in the county are accurate, complete, and up to date. This role safeguards fair taxation, legal compliance, and public trust while helping residents and businesses make informed decisions.

Property Assessment and Valuation

The Miami County Auditor oversees the property assessment office, responsible for determining the value of every parcel of land and building in the county. Accurate valuations are crucial because they directly affect property taxes, which fund schools, roads, and public services. By applying standardized appraisal methods, the auditor ensures fairness and consistency across all property types.

Property assessments consider factors such as:

- Market value based on recent sales of comparable properties

- Property condition and improvements

- Location and zoning regulations

For example, if a residential property recently sold for $250,000, the auditor’s office uses that data alongside other neighborhood sales to determine a fair assessed value. Homeowners who disagree with the valuation can appeal, allowing an independent review that supports legal compliance and fair taxation.

Tax Record Management

Managing tax records is a central responsibility of the Miami County Auditor. This includes maintaining accurate accounts for property taxes, distributing tax revenue to local entities, and tracking payments. Proper record management ensures that all residents are taxed fairly and that municipal and county services receive funding without disruption.

The office handles:

- Recording property tax bills and payment status

- Calculating delinquent taxes and penalties

- Coordinating with other government offices for accurate revenue allocation

For instance, Miami County collects millions in property taxes annually. Accurate record-keeping allows the auditor to provide residents with correct bills and detailed tax calculations, reducing errors and promoting public trust.

Financial Transparency & Auditing

The auditor also plays a key role in auditing county funds to ensure accountability. By reviewing financial transactions, budgets, and public expenditures, the auditor maintains transparency and strengthens confidence in local government.

Key responsibilities include:

- Performing audits on county departments and programs

- Identifying discrepancies or errors in public accounts

- Publishing reports that detail findings and support fair use of funds

These practices support the county’s tax authority by making certain that resources are used efficiently and legally. By promoting financial transparency, the Miami County Auditor protects taxpayers and enhances confidence in local government operations.

Accessing Miami County Court Records

Searching court records in Miami County begins with the right method and the official online tools provided by the county government. Users can view civil, criminal, family, and probate cases through the County’s public access search system. These records help residents, property buyers, attorneys, and researchers find case details, filings, and legal documents that are maintained as public records by the county.

How to Search Court Records

To find court records correctly:

Choose the Right Type of Record

- Civil or criminal cases

- Probate, family law, or property-related filings

Courtview Case Search

- Open the Public Access Page

Visit the Miami County Public Access page to begin your search.

➤ https://www.miamicountyohio.gov/684/Public-Access

- Select a Search Option

Choose one of the following:- Courtview Case Search for civil, criminal, and municipal court cases

- Probate Case Search for estate and probate-related cases

- Open the Case Search Tool

Clicking on either option will open the official case search form.

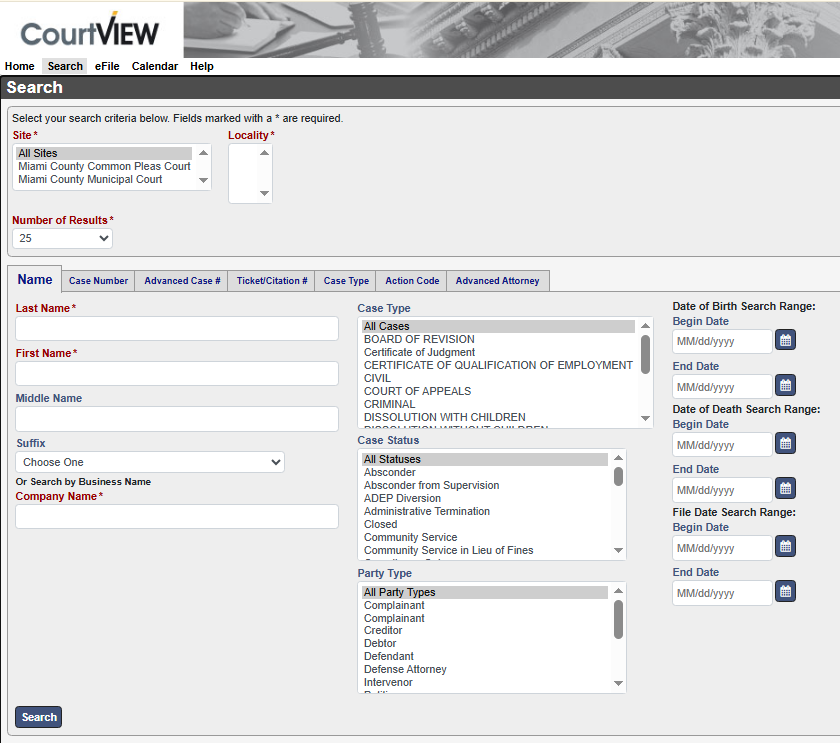

- Enter Search Information

Fill in the required fields such as:- Last Name and First Name (required)

- Case Number or Company Name (optional)

- Apply Filters (Optional)

Narrow results using case type, case status, or date range. - Run the Search

Click the Search button to view matching case records. - View Case Details

Select a case number from the results to see detailed case information.

Probate Case Search:

- Open the Probate Case Search Page

Visit the official Miami County Probate Court Case Dockets Search page. - ➤ https://co.miami.oh.us/1046/Case-Dockets-Search

- Access the CaseLook Search Tool

The page will open the CaseLook probate search form used by the Miami County Probate Court.

- Enter Search Information

You can search using one option at a time:- Name / Company (last name first)

- Case Number

- File Date (month, day, and year)

- Select Case Type

Choose one or more case categories:- Civil

- Estate

- Guardianship

- Marriage

- Trusteeship

- Miscellaneous

- Choose Results Per Page

Select how many matches to display:- 25, 50, 100, or 250 results per page

- Complete CAPTCHA Verification

Enter the CAPTCHA code shown on the screen to verify the search request. - Begin the Search

Click the Begin Search button to view probate case records. - View Case Results

The system will display matching probate cases. Click a case entry to see detailed docket information.

Enter Your Search Criteria

Use party names, case numbers, or docket numbers as search terms. The case search tools will display case summaries, filing dates, parties involved, and types of court documents.

Review and Save Results

Once results appear, users may view docket entries online or request official copies when needed. Some formats may allow downloads directly from the official system.

Where to View Clerk,

Here are the official places where Miami County court records can be found:

- In-Person at the Miami County Clerk of Courts Office

- Official physical location to request certified copies or older files.

- Clerk office info: https://www.co.miami.oh.us/117/Clerk-of-Courts

- Hours, contact data, and services are listed on the Clerk of Courts page.

Miami County, Ohio, Auditor’s Public Records for Related Filings

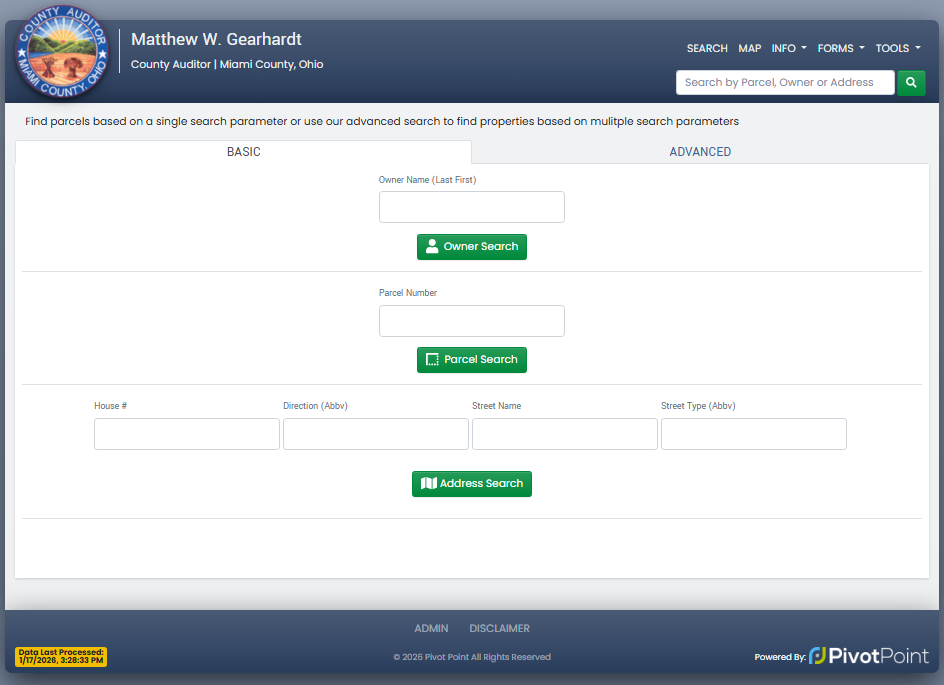

- Open the Property Search Page

Visit the official Miami County Auditor property search page. - ➤ https://www.miamicountyohioauditor.gov/Search

- Choose a Search Method

You can search property records using one option at a time:- Owner Name Search – Enter the owner’s name (last name first).

- Parcel Number Search – Enter the parcel number if known.

- Address Search – Enter house number, street direction, street name, and street type.

- Enter Search Details

Fill in the required information in the selected search field only. - Run the Search

Click the corresponding button:- Owner Search

- Parcel Search

- Address Search

- View Property Results

The system will display matching property records, including ownership and parcel details. - Open Property Details

Click a record to view detailed property information provided by the Miami County Auditor.

Cost Reference Table for Court Records

| Access Method | Records Type | Search Fee | Document Fee | Official Source |

|---|---|---|---|---|

| Courtview Case Search | Civil / Criminal / Municipal cases | Free | Varies by copy | Public Access Links |

| Probate Case Search (RCAS) | Probate Division cases | Free | No charge for on‑screen view | RCAS Case Dockets |

| Miami County Clerk of Courts | All official court files | Free to search | Certified copies per page | Clerk of Courts |

| Auditor Search (Property‑linked filings) | Property tax liens, related records | Free | Varies | Auditor Search Tool |

Miami County Auditor Services

The Miami County Auditor’s Office provides a wide range of services that help residents, business owners, and property professionals manage property, taxes, and public records efficiently. These services are designed to offer accurate information, transparency, and practical tools for financial and legal decision-making.

Miami County Auditor Services

The Miami County Auditor’s Office provides residents, business owners, and property professionals with tools and services to manage property, taxes, and public records efficiently, offering accurate information, transparency, and practicality.

Property Valuation and Tax Estimation

The Auditor’s Office ensures fair property valuations and accurate tax calculations across Miami County, allowing residents and businesses to use the tax estimator and check local property tax rates. Updated records reflect property sales, improvements, and ownership changes, supporting informed financial decisions. Tools like the online tax estimator, property tax rate tables, and assessment updates make it easier to plan budgets, verify values, or file appeals while maintaining financial transparency and accountability.

Homestead Exemption Programs

The Homestead Exemption provides financial relief to qualifying homeowners by reducing the taxable value of their primary residence. This program is managed through the property assessment office, which verifies eligibility and applies the exemption to property tax bills. The exemption can significantly lower the annual tax burden, especially for seniors or residents with limited income. Applying for this benefit involves submitting the required documents and proof of residence.

Benefits include:

- Reduced property taxes for eligible homeowners.

- Simplified online application process through the Auditor’s website.

- Support for seniors, disabled residents, and low-income households.

By offering these programs, the Auditor ensures fairness in taxation while maintaining legal compliance and supporting residents’ financial stability.

Public Records Access

As the county’s public records office, the Auditor’s Office provides secure access to property records, tax information, and legal documents, including the court docket and filings with the Clerk of Court. Updated records allow residents, legal professionals, and investors to verify ownership, track sales history, or review civil and criminal case information, while online tools make it simple to request documents quickly, promoting accuracy and public trust.

Marriage, Divorce, and Legal Documents

The Auditor’s Office also manages marriage and divorce records along with other vital documents. These records are essential for legal compliance, estate planning, and personal documentation purposes.

Services include:

- Viewing and requesting certified marriage and divorce certificates.

- Access to legal records for verification or administrative purposes.

- Secure online and in-person submission options to maintain confidentiality.

By maintaining these records accurately, the office ensures that residents have reliable legal documentation while supporting proper recordkeeping for county administration.

Dog Licensing

Pet owners in Miami County can register pets through the Auditor’s Office to maintain a dog license in compliance with local regulations. Licensing protects pets, promotes safety, and funds animal welfare programs.

Key points:

- Online and in-person license registration available.

- Licensing fees support animal control, vaccination programs, and lost pet recovery.

- Ensures regulatory compliance for all pet owners.

By offering clear procedures and accessible tools, the Auditor’s Office simplifies the dog licensing process, making it convenient for residents while maintaining county standards.

Property Tax Information

Property taxes in Miami County are calculated based on the assessed value of each property and the current tax rates set by local authorities. The Miami County, Ohio, Auditor ensures these rates are accurate, transparent, and applied fairly to every property owner.

Tax Rates

Property tax rates in Miami County vary depending on the type of property and its location within the county. Residential, commercial, and agricultural properties are taxed at different rates, all set annually by local government authorities and approved by voters. These rates reflect the funding needed for schools, public safety, and county services.

For example, a residential home assessed at $200,000 with a total tax rate of 2.5% would have an annual property tax of:

$200,000 × 0.025 = $5,000

Property owners can check their specific rates using the Miami County, Ohio, Auditor’s official resources, which list current levies and millage rates for each township or city. Rates are broken down into categories such as county taxes, school district taxes, and municipal levies, giving homeowners a clear picture of how their taxes are allocated.

Understanding these tax rates helps residents plan their budgets, anticipate annual tax bills, and stay compliant with county regulations. LSI terms like tax authority, public records office, and financial transparency apply here, reinforcing clarity about the county’s fiscal management.

Using the Tax Estimator Tool

The tax estimator tool provided by the Miami County Auditor allows residents to calculate their expected property taxes quickly and accurately. Users enter the property value, classification, and location, and the tool estimates their annual tax obligation. This ensures financial transparency and supports informed decision-making for homeowners, investors, and businesses.

Key steps for using the tool effectively:

- Enter property address or parcel number to locate the property record.

- Check the assessed value listed by the auditor’s office.

- Apply current tax rates for the applicable township or city.

- View estimated tax broken down by county, school, and municipal taxes.

This tool also allows property owners to model different scenarios, such as the effect of changes in assessment value or exemptions like the homestead program, providing a practical view of potential savings. Using LSI terms such as property assessment office and tax records throughout the section reinforces Google’s semantic understanding of the page.

Appealing Property Valuation

If a property owner believes their valuation is inaccurate, they have the right to file an appeal through the Miami County Auditor’s office. The appeal process follows strict audit procedures and legal compliance requirements to ensure fairness and transparency.

Steps for appealing a property valuation:

- Review the current assessment: Compare it with similar properties in the area.

- Collect supporting evidence: Include recent appraisals, property improvements, or sales data.

- Submit a formal appeal: File through the auditor’s office within the designated timeframe.

- Attend a hearing: Present evidence to the Board of Revision if necessary.

Successful appeals can lead to adjusted assessments, which directly impact annual taxes. Integrating terms like legal compliance, audit process, public trust, and financial transparency here strengthens the content’s semantic relevance while providing actionable information to residents.

Court Records & Public Records

Miami County provides residents and businesses with secure access to court and public records, including case filings, property histories, and vital legal documents. The Clerk of Court maintains these records, ensuring accuracy and legal compliance, while tools like the court docket give real-time updates on hearings, judgments, and filings to promote public trust. Users can access many records online or visit county offices in Troy, Ohio, for certified copies and in-person assistance.

Marriage and divorce records are also managed through the county’s public records office, offering verified documentation for legal, financial, or research purposes. Residents, researchers, and businesses benefit from these resources by confirming ownership disputes, tracking legal cases, or updating official documentation. Using these services ensures accurate information, supports responsible decision-making, and strengthens transparency across Miami County.

Accessing Miami County Legal & Public Records

Miami County residents and businesses can view legal and public records quickly through the Auditor’s online tools or by visiting county offices in person. These records include court cases, property histories, and vital documents that support transparency and accountability in the county.

Clerk of Court

The Clerk of Court manages all official legal documents in Miami County, ensuring accuracy and compliance with Ohio law. Residents can find civil, criminal, and traffic case information, as well as legal filings related to probate, domestic relations, and small claims.

- Online Access: Many documents are available on the Clerk of Court website, allowing users to search by case number, party name, or filing date.

- In-Person Requests: Visiting the Clerk’s office in Troy, Ohio, provides access to physical records, certified copies, and assistance from trained staff.

- Tips for Users: Lawyers, researchers, and property investors benefit from using official case indexes to confirm ownership disputes or pending legal actions.

Using these resources helps maintain legal compliance and supports the county’s transparency efforts, giving residents confidence in the fairness of the judicial system.

Court Docket

A court docket is a record of all scheduled hearings, case updates, and judgments in Miami County courts. Maintaining a complete and accurate docket ensures public trust and helps individuals track case progress efficiently.

- Search Methods: Court dockets can be accessed online by case type or party name, offering real-time updates for civil, criminal, and administrative cases.

- Offline Access: Residents may review the official docket at the Clerk of Court’s office for official confirmations or certified copies.

- Benefits for Users: Property buyers, attorneys, and local businesses can check pending litigation or judgments that may affect property or contractual agreements.

By consulting the court docket, users gain insight into the judicial process and ensure compliance with legal obligations.

Marriage & Divorce Records

Marriage and divorce records are part of the county’s public records office, providing verified documentation of marital status for residents. These records are often required for legal purposes, background checks, or genealogical research.

- Online Requests: Certain records can be requested through the Miami County Auditor or the Clerk of Court portal.

- In-Person Requests: Certified copies can be obtained at county offices with proper identification and applicable fees.

- Practical Uses: Researchers, financial institutions, and families use these records to confirm legal status or update official documentation.

Keeping these records accurate and accessible strengthens public trust and supports smooth legal and financial transactions across the county.

How to Contact the Auditor

The Miami County Auditor’s office is available to assist residents with property records, tax information, and general inquiries. Residents can reach the office by phone, email, or by visiting in person for support from the public records office.

For direct assistance, the Miami County Auditor’s office provides clear contact options:

- Office Address:

201 West Main Street, Troy, Ohio 45373 - Phone Number:

(937) 440-5925 - Email:

auditor@miamicountyohio.gov - Office Hours:

Monday – Friday: 8:00 AM – 4:30 PM

Closed: Saturday & Sunday

Frequently Asked Questions About Miami County Auditor

Residents and property owners in Miami County often have questions about taxes, property records, and public services. The Miami County Auditor’s office provides clear, reliable answers to help residents navigate assessments, records, and licenses while maintaining financial transparency and public trust.

How are property taxes calculated in Miami County?

Property taxes in Miami County are based on the assessed value of each property and the local tax rates set by the county and other authorities. The Miami County Auditor ensures all property valuations are accurate and fair, providing transparency and maintaining public trust. The property assessment office evaluates properties by considering size, location, improvements, and recent sales. After determining the assessed value, the county’s tax authority applies the local, municipal, and school district tax rates to calculate the total tax owed. Homeowners can access property values, tax amounts, and parcel information through the Auditor’s online portal, where exemptions such as the Homestead Program are also reflected. This approach ensures residents receive reliable information while the Auditor upholds legal compliance and equitable treatment.

Can I appeal my property valuation?

Yes, property owners in Miami County can appeal their property valuations if they believe the assessed value is incorrect, and the Auditor’s office carefully manages these appeals to ensure fairness and legal compliance. To appeal, property owners submit supporting evidence such as appraisals, photographs, or comparable sales to the property assessment office, which reviews each case thoroughly. If the evidence justifies a change, the assessed value may be adjusted, providing residents with confidence in the process. This system maintains public trust by treating all property owners equitably and reinforcing accountability in property taxation.

How do I apply for a dog license?

Applying for a dog license in Miami County is straightforward and helps ensure pets are registered, vaccinated, and properly identified, contributing to community safety. The Miami County Auditor manages dog licensing through the public records office, and residents can apply online, by mail, or in person. Applications require details about the dog, including breed, age, and proof of rabies vaccination, along with payment of the applicable license fee. Once issued, the license tag should be attached to the pet’s collar for quick identification. Licensing supports animal welfare programs and reinforces financial transparency and responsible pet ownership in the county.

How to perform a property search online?

Performing a property search in Miami County is simple using the Auditor’s online tools, which provide accurate property details, ownership records, and tax information. The property assessment office maintains these records, and users can search by owner name, property address, or parcel number to access comprehensive data. The GIS Parcel Viewer also displays property boundaries and mapping details, allowing in-depth exploration of parcels throughout the county. This tool ensures financial transparency and accountability, helping residents verify property information, track tax records, and make informed real estate decisions.

What online services are available from the Miami County Auditor?

The Miami County Auditor offers a wide range of online services to make property management and record access easier for residents. Through the Auditor’s portal, users can view property valuations, check tax bills, download forms, apply for exemptions, request public records, and pay property taxes. These services are supported by the property assessment office and other departments to maintain accuracy and efficiency. By providing convenient digital access, the Auditor enhances public trust, ensures legal compliance, and allows residents to manage their property and tax responsibilities effectively without visiting the office in person.