The Miami County Auditor’s Office manages the county’s finances, oversees tax distribution, and ensures all public funds are accurately accounted for. As the chief fiscal officer, the Auditor monitors real estate, personal property, and manufactured home taxes, distributes government funds to townships, schools, cities, and libraries, and maintains detailed financial records to guarantee transparency and accountability. Residents can contact the office directly at its Troy, Ohio, location for tax inquiries, public office services, or assistance with county financial records.

The Miami County Auditor’s Office manages county employee payroll, motor vehicle license fees, gasoline taxes, estate taxes, and fines to ensure all transactions are processed accurately and on time. As the Official Miami County Auditor Site, it prepares the Comprehensive Annual Financial Report (CAFR) and maintains transparent public financial records for residents, businesses, and local government agencies. The office also supports property searches, dog licenses, and essential county forms, helping maintain financial stability and efficient access to government services across Miami County.

About the Auditor’s Office

The Miami County Auditor’s Office manages the county’s finances and ensures public funds are properly accounted for. This office oversees the distribution of money to local governments, schools, libraries, and county agencies. The Auditor serves as the chief fiscal officer of the county, responsible for maintaining accurate records of all receipts, disbursements, and fund balances. Every year, the office carefully tracks millions of dollars in revenue, ensuring that payments are issued promptly and correctly. This includes issuing warrants or checks for county obligations and making sure that townships, cities, school districts, and library systems receive their allocated funds without delay.

One of the key responsibilities of the Auditor’s Office is preparing the Comprehensive Annual Financial Report (CAFR). This report provides a detailed account of all county finances, showing residents how funds are collected, managed, and spent. It is a critical tool for financial oversight and maintaining transparency in public office services. The office also monitors fund balances across departments, ensuring each department has the resources it needs while maintaining fiscal responsibility. By carefully managing county funds, the Auditor helps support essential community services, including education, infrastructure, and public safety.

Functions of the Auditor’s Office:

- Accounting for county funds to maintain accurate financial records.

- Issuing warrants and checks for all county payments.

- Distributing taxes and funds to townships, cities, schools, and libraries.

- Preparing the CAFR to summarize financial activity and balances.

- Overseeing fund balances to ensure fiscal responsibility and transparency.

With a focus on clear reporting and efficient management, the Miami County Auditor’s Office ensures residents can trust that public funds are handled carefully and effectively.

Online Services and Tools

The Miami County Auditor’s Office offers several convenient online services that make handling property, taxes, and licenses straightforward. Residents can perform searches, complete forms, and manage payments from any device, saving time and effort.

Property Search Tool

Residents can quickly search real estate records using the property search tool, which provides detailed information on parcels, ownership, and assessed values. This tool is supported by GIS maps, allowing https://www.co.miami.oh.us/116/Boards-Commissions users to view property boundaries and neighborhood layouts easily. Alongside property searches, the office provides online forms for various administrative needs, such as property tax payments, permit requests, and document submissions, reducing the need for in-person visits.

Dog Licensing Portal

The dog licensing portal allows pet owners to https://secure.lglforms.com/form_engine/s/x5zxA_b6-nY26Mldwwc39A register their dogs, renew licenses, and pay fees digitally. It includes reminders for renewals and links to local regulations, helping residents stay compliant with county requirements.

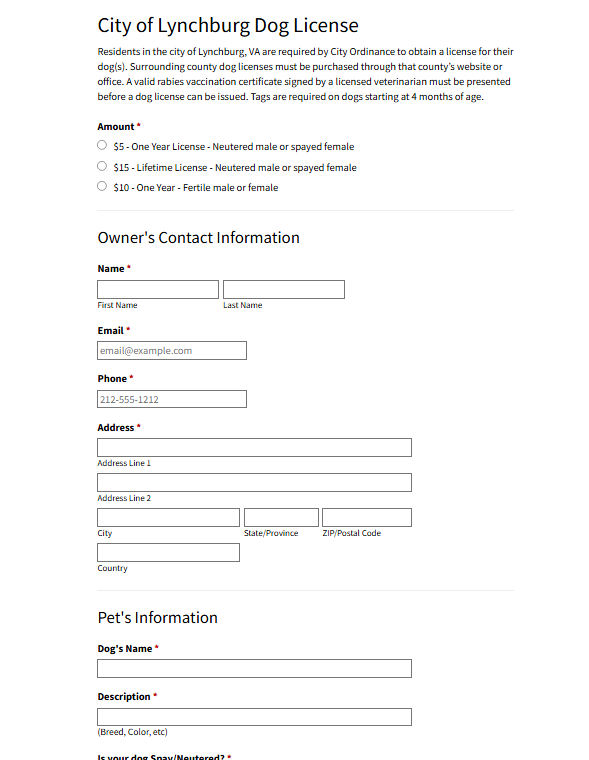

How to Use the City of Lynchburg Dog License Tool

- Open the official City of Lynchburg Dog License online form.

- Select the correct license type based on your dog’s spay or neuter status.

- Enter the owner’s contact information, including name, email, phone number, and address.

- Provide your dog’s details such as name, breed, color, sex, and age.

- Indicate whether your dog is spayed/neutered or microchipped.

- Upload a valid rabies vaccination certificate issued by a licensed veterinarian.

- Complete the security verification to confirm you are not a robot.

- Review all details and submit the form to proceed with secure payment.

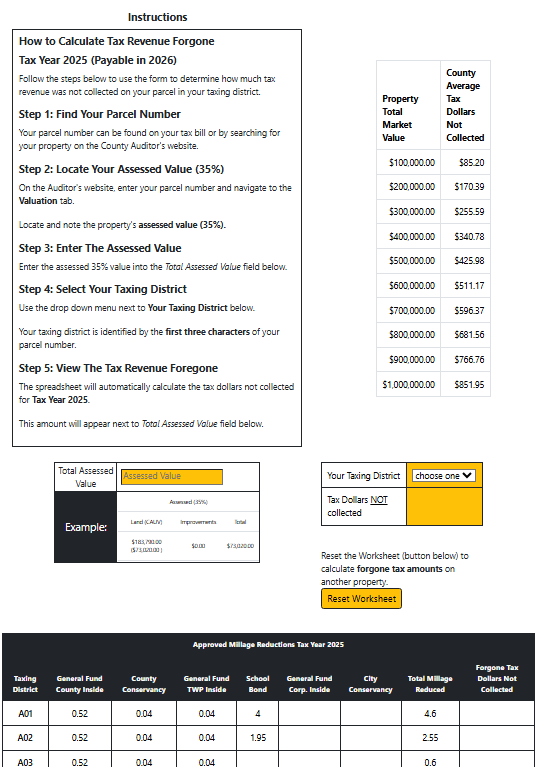

Tax Calculators and Payment Tools

To simplify financial transactions, the Auditor’s Office offers tax calculators and online payment tools. Residents can calculate real estate or personal property taxes, schedule payments, and review their https://www2.miamicountyohio.gov/auditoria/ transaction history through official tax payment portals. These digital resources save time and minimize errors while providing instant confirmation of submissions.

Benefits of Using Online Tools

Key advantages of these online services include:

- Real-time property data through GIS maps

- Secure and fast payment processing for taxes and fees

- Easy access to forms for licenses, permits, and documents

- Digital reminders for dog license renewals and tax deadlines

Core Responsibilities and Services

The Miami County Auditor’s Office manages county finances and ensures public funds are distributed accurately. It oversees tax collection, employee payroll, and a variety of local government payments to maintain smooth county operations. The Auditor serves as the county’s chief fiscal officer, handling the distribution of funds to townships, cities, school districts, libraries, and other county agencies. One of the office’s main duties is payroll management for all county employees, making sure staff are compensated accurately and on time. In addition, the office manages the flow of motor vehicle license fees, gasoline taxes, estate taxes, and fines, ensuring these payments support essential local services.

Property and tax administration is another critical responsibility. The Auditor collects and manages real estate taxes, personal property taxes, and manufactured home taxes, tracking payments and ensuring proper allocation to schools, municipalities, and county programs. This role requires careful oversight of county obligations, keeping official records of receipts, disbursements, and fund balances to maintain transparency and accountability.

Property Tax Administration

The Auditor’s Office oversees property tax assessments and collection. This includes maintaining property records, updating tax rolls, and assisting residents with tax inquiries. Accurate management of property taxes ensures that local governments and schools receive the resources they need. Residents can also access public information on property valuations, assessments, and payments through online tools provided by the office.

Financial Reporting & Accountability

The office prepares the Comprehensive Annual Financial Report (CAFR) each year, detailing all county revenues, expenditures, and fund balances. This report supports transparency, helping residents understand how their tax dollars are allocated. Additionally, the Auditor conducts internal audits to ensure public office services are consistent, reliable, and compliant with state regulations.

Contact the Auditor’s Office

Residents and businesses can reach the Miami County Auditor’s Office directly for questions about taxes, payroll, or public office services. The office is located in Troy, Ohio, and is available during standard business hours. The Miami County Auditor’s Office is located in the Safety Building at 201 W Main Street, Troy, Ohio. Office hours are Monday through Friday, 8:00 AM to 4:00 PM, providing ample opportunity for residents to handle inquiries in person or by phone. Staff are prepared to assist with property tax information, license fees, payroll questions, and other county financial matters.

Contact Information:

- Phone Number: 937-440-5925

- Fax: 937-440-5919

- Email: auditor@miamicountyohio.gov

For residents who need assistance, visiting the office in person can provide direct support, while phone or email communication offers a quick way to resolve most questions. The office team ensures accurate processing of financial records and timely distribution of funds to townships, cities, school districts, and county agencies.

Staff Directory

The Auditor’s Office maintains a skilled staff dedicated to county operations:

- Auditor: Matthew W. Gearhardt – Oversees all financial operations, tax distribution, and reporting.

- Deputy Auditor: Angela Hubbard – Assists with payroll, accounting, and public inquiries.

- Administrative Staff: Handles records, communications, and forms for residents.

Residents can contact specific staff members directly for faster responses on property records, licenses, or other public office services. Clear points of contact and accessible office hours ensure the Auditor’s Office remains approachable and responsive.

Forms & Downloads

The Miami County Auditor’s Office provides a centralized location for all important forms, ensuring residents can easily complete property tax, payroll, claims, and licensing tasks. These documents are available for download and use, saving time and simplifying administrative processes.

Residents and businesses can find a wide variety of audit forms for different purposes. The property tax forms allow homeowners and property managers to manage assessments, exemptions, and payment options efficiently. For county employees, payroll and claims forms are available to streamline salary distribution and reimbursements. Additionally, licenses such as dog licenses or other permits are included, helping residents stay compliant with local regulations.

Important Documents

- Property Tax Forms: Exemptions, assessments, and payment requests

- Payroll & Claims Forms: Employee payroll setup and expense claims

- Licenses & Permits: Dog licenses, vendor permits, and other regulatory forms

Each document includes clear instructions to ensure proper completion. Users can also follow internal links to official portals and PDF forms, which are updated regularly to reflect the latest county regulations. This section also highlights helpful information like filing deadlines and contact details for questions regarding specific forms.

News, Announcements & Deadlines

The Miami County Auditor’s Office provides timely updates on taxes, property reappraisals, and important county news. Residents can stay informed about deadlines that affect property payments and other public services. Keeping current with Miami County Auditor updates ensures residents meet key obligations and avoid penalties. The Auditor regularly posts announcements regarding tax deadlines, property reappraisal schedules, and changes in local government procedures. These updates are critical for homeowners, business owners, and other stakeholders who rely on accurate and timely information for planning and compliance.

Residents can easily track upcoming events and deadlines through the Auditor’s office, including:

- Property Tax Deadlines: Specific dates for quarterly or annual payments.

- Reappraisal Notices: Updates on property value assessments that may affect taxes.

- Public Announcements: Changes in fees, licensing, or county fund allocations.

The office emphasizes transparency and accessibility, making all updates available through its website and official communications. Staying informed about the auditor’s office news helps the community plan finances, prepare documents, and respond to county requirements efficiently.

(FAQ) About the Auditor’s Office

Residents often have questions about the auditor’s office hours, property taxes, and contacting the Miami County Auditor. The office provides clear processes for paying property taxes, registering dog licenses, and handling payroll or general inquiries. This FAQ section answers the most common questions to help residents quickly find the information they need.

How can residents pay property taxes online?

Residents can pay property taxes securely through the Miami County Auditor’s online portal. By entering their parcel number and following the on-screen instructions, they can submit payments using a credit card, debit card, or electronic check. The system provides instant confirmation of each payment, and residents can access records of previous payments and account balances. Paying online ensures that tax funds are distributed promptly to townships, school districts, libraries, and other local agencies, while reducing the need for in-person visits.

How do I register dog licenses in Miami County?

Dog owners must register their pets annually with the Miami County Auditor’s office to comply with county regulations. Registration can be completed online or in person by submitting a completed form and proof of rabies vaccination. Once payment of the annual fee is made, owners receive a license tag for their pet. This registration system helps maintain accurate public records, supports community safety, and provides reminders for license renewals. Residents can also manage multiple pets under one account for convenience.

Who should I contact for payroll or general inquiries?

County employees seeking assistance with payroll should contact the Auditor’s Payroll Department during office hours, while residents with questions about property taxes, forms, or public office services can reach the main Miami County Auditor contact line. The office is open Monday through Friday from 8:00 AM to 4:00 PM, and staff are available by phone at 937-440-5925 or through the online contact form. The team provides guidance on payments, verifies documents, and ensures accurate handling of financial reports and tax distributions. Clear communication with the Auditor’s office helps residents and employees resolve questions efficiently.

What are the Miami County Auditor’s office hours?

The Miami County Auditor’s office operates Monday through Friday from 8:00 AM to 4:00 PM. Residents and county employees can visit in person during these hours for property tax assistance, document submission, or general inquiries. For those who cannot visit in person, the office provides phone and online support. Knowing the office hours helps residents plan visits, submit timely payments, and ensures access to services like payroll verification and licensing without delays.

Where is the Miami County Auditor’s office located?

The Auditor’s office is located in the Miami County Safety Building at 201 W Main Street, Troy, Ohio. This central location provides easy access for residents and county staff seeking public services. The office is equipped to handle property tax payments, payroll questions, dog license registration, and requests for public records. Visitors can also contact the office by phone at 937-440-5925 or use the online contact form for questions or document submissions. Clear directions and contact details help residents efficiently reach the services they need.