Residents seeking property record copies in Miami County can request official copies through the Assessor’s or Recorder’s office. These documents include deeds, tax assessments, and assessor records, providing verifiable details about ownership, property value, and legal descriptions. Obtaining a public records request ensures that each document reflects the county’s official records, whether for legal verification, title transfers, or financial purposes. Requests can be submitted online, in person, or by mail, depending on the type of record required and the office maintaining it.

Certified property record copies carry legal weight for transactions, court proceedings, or mortgage closings, while uncertified copies serve as reliable personal references. Each record documents property history, boundaries, and ownership succession, giving residents and professionals a transparent view of any Miami County property. The process often requires key details, such as parcel number, property address, or owner information, and ensures compliance with county regulations. Many of these records can be accessed conveniently through the Miami County Auditor Main Portal, providing a centralized online resource for searching, viewing, and requesting official documents. Miami County offices maintain these documents with accuracy, allowing users to reference official information confidently. Multiple types of records are available, including deeds, valuation statements, and tax histories, all preserved as assessor records or official document copies.

How Property Records Work in Miami County

Property records in Miami County include official documents that track ownership, land use, and taxation for properties throughout the county. These records are maintained by specific county offices and are available to the public for reference or official purposes.

Property records typically fall into three main categories: property deeds, assessor records, and property tax records. Property deeds provide proof of ownership and include details such as past and current owners, property boundaries, and legal descriptions. Assessor records contain property valuations, building details, and land assessments used for tax purposes. Property tax records track tax amounts owed, payment history, and delinquency status for individual properties. Anyone who needs this information can request property records from Miami County through the appropriate county office.

Types of Copies: Certified vs. Uncertified

When obtaining property records, it is important to note the difference between certified and uncertified copies. Certified property record copies are official documents verified by the county office, often required for legal matters, real estate transactions, or mortgage purposes. Uncertified copies provide the same information but are not verified, and they typically serve personal or research needs. Most county offices allow residents to specify the type of copy needed when making a request.

Which Office Maintains Which Records

Different county offices maintain specific types of property records:

- Miami County Auditor’s Office: Handles assessor records, property valuations, and some property tax information.

- Miami County Recorder’s Office: Maintains property deeds, land records, and documents related to ownership transfers.

- Miami County Treasurer: Focuses on property tax records, payment history, and delinquency information.

Which office manages each type of record helps streamline requests and ensures faster processing. Using official sources also reduces errors and ensures that the documents received are accurate and complete.

Steps to Request Property Record Copies

Requesting property record copies in Miami County can be done online, in person, or by mail. Each method provides residents with official copies of records while following the proper procedures established by the county.

Online Requests

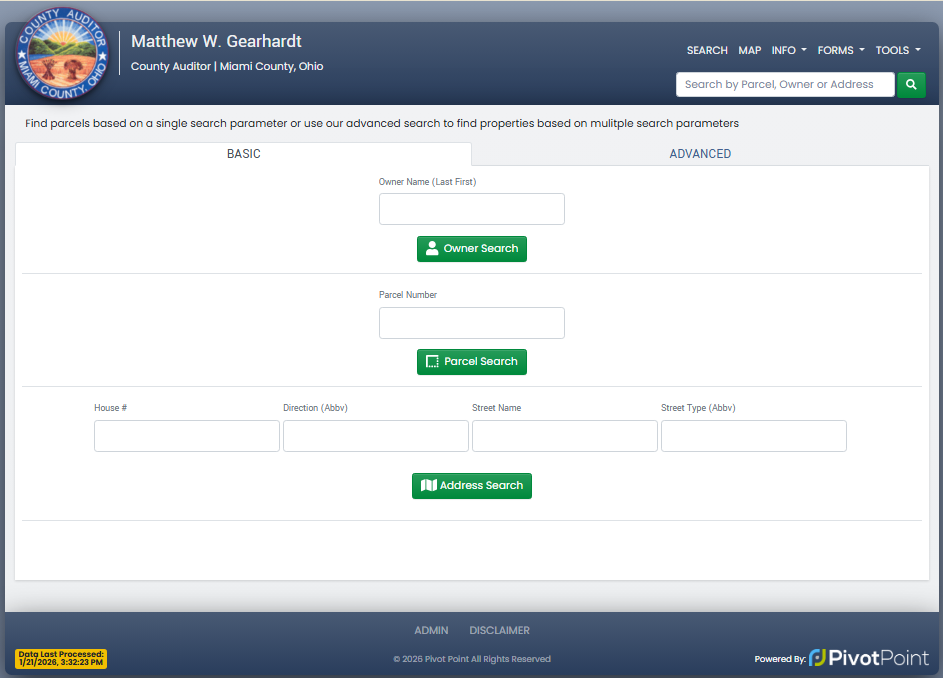

Property record copies can be requested online through the Miami County Auditor’s official property search tool. This method provides convenience and allows applicants to obtain official copies without visiting the office. The public records request process begins by visiting the official property search page: Miami County Auditor Property Search. Once there, users can search for properties using the parcel number, owner name, or property address. After identifying the correct property, they can submit a record retrieval request for the specific documents they need, such as property deeds, tax records, or assessor records.

Steps for Online Requests:

- Visit https://www.miamicountyohioauditor.gov/Search

- Enter the parcel number, owner name, or property address in the search fields.

- Select the desired record type from the available options.

- Complete the official copy request form with your contact information.

- Pay any required fees online using the secure payment options.

- Submit the request and save any confirmation number provided.

Online requests typically take a few business days to process, depending on the type of record requested. Applicants can track the record retrieval process through the portal or by contacting the Auditor’s office directly.

In-Person Requests

Residents can also request property records in person at the Miami County Auditor or Recorder’s offices. This method allows applicants to review assessor records and property deeds directly and obtain copies immediately in some cases.

Steps for In-Person Requests:

- Visit the Miami County Auditor’s Office or the Recorder’s Office.

- Bring a valid photo ID and, if available, the parcel number or property address.

- Fill out the property record request form provided by the office.

- Specify whether certified or uncertified copies are needed.

- Pay any applicable fees at the counter.

- Receive the copies either on-site or arrange for mailing.

Office Locations and Hours:

| Office | Address | Hours |

|---|---|---|

| Miami County Auditor | 201 W. Main St., Troy, OH 45373 | Mon–Fri, 8:30 a.m.–4:30 p.m. |

| Miami County Recorder | 201 W. Main St., Troy, OH 45373 | Mon–Fri, 8:30 a.m.–4:30 p.m. |

Bringing the parcel number or property details speeds up the request process. Staff can assist with locating assessor records, tax information, and property deeds, ensuring the correct documents are provided.

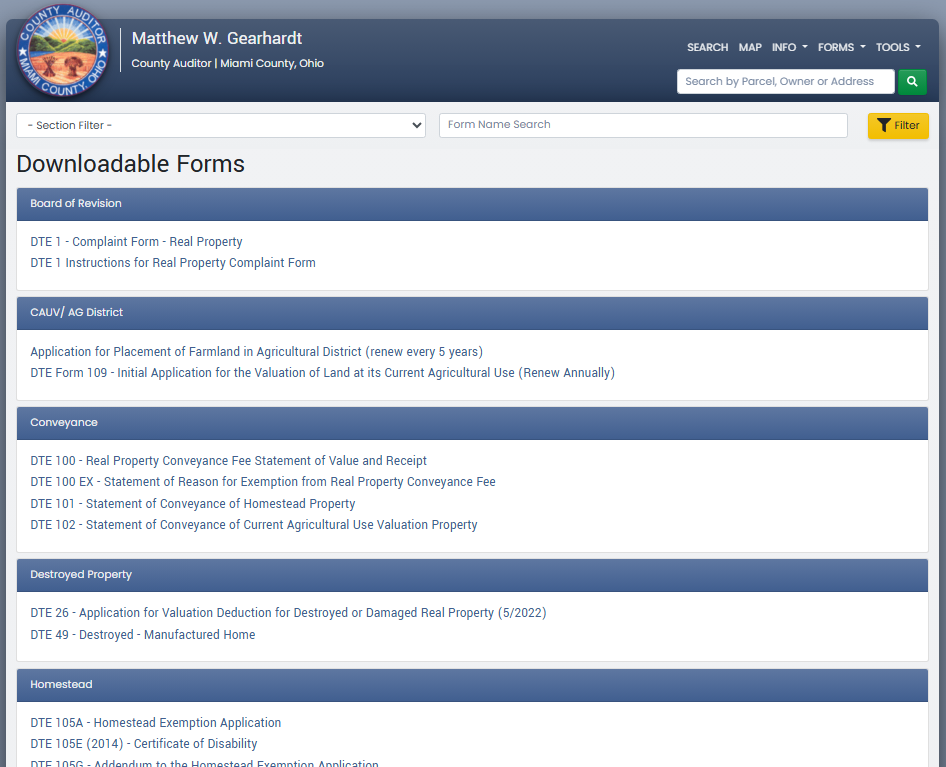

Mail Requests

Property record copies may also be requested by mail, which is useful for those unable to visit the offices in person. Applicants can request certified property record copies using the official forms and submit payment along with their request.

Steps for Mail Requests:

- Download the official property record request form from the Auditor or Recorder websites:

- https://www.miamicountyohioauditor.gov/Forms

- Complete all sections, specifying the type of records needed and whether certified copies are required.

- Include the parcel number, property address, or owner’s name to ensure accuracy.

- Attach a check or money order for the applicable fees.

- Mail the request to the office address provided on the form.

Who Can Request Property Record Copies

Anyone interested in Miami County property information can request copies, but eligibility varies depending on the type of record. Property owners, legal representatives, and members of the public each have specific rights and procedures for obtaining these documents.

Property Owners: Broad Access to Copies

Miami County property records are considered public documents, yet the process for obtaining them differs depending on the requester. Property owners typically have the broadest access, including both certified and uncertified copies. They can request official copies for personal use, real estate transactions, or legal purposes. Certified copies carry legal recognition and may be required for court filings, title transfers, or mortgage verification.

Legal Representatives: Requesting on Behalf of Clients

Legal representatives such as attorneys, title agents, or trustees may also submit a request for property record copies on behalf of clients. When doing so, they often need to provide proper documentation demonstrating authorization. This ensures the request aligns with county policies and protects sensitive information.

General Public: Limited Access and Uncertified Copies

For the general public, property records are accessible but may have limitations. Public requests often result in uncertified copies, which are suitable for research or informational purposes but do not hold legal certification. The process of a document copy request for public users is straightforward: it usually involves submitting a written or online form specifying the property details, including parcel number, property address, or owner name.

Certified vs Uncertified Copies

Certified property record copies are official documents that carry a seal or signature from the Miami County Auditor or Recorder, confirming their authenticity. Uncertified copies, on the other hand, are standard reproductions of records that do not hold legal weight. Certified copies serve as legally recognized proof of property ownership, deeds, and other official transactions. They are essential in situations where a verified record is required by courts, financial institutions, or government agencies. For instance, when selling a property or applying for a mortgage, a certified copy of the deed or property tax record ensures the document is recognized as legitimate.

Uncertified copies provide the same information as certified copies but cannot be used for legal or official purposes. They are useful for reference, personal record-keeping, or initial research on a property. For example, a homeowner may use an uncertified copy of the property tax record to review past payments or confirm parcel details without needing official verification.

Differences Between Certified and Uncertified Copies:

| Feature | Certified Copy | Uncertified Copy |

|---|---|---|

| Legal Weight | Recognized by courts and institutions | Informational only |

| Official Seal | Yes, with signature or stamp | No |

| Fees | Usually higher | Often lower or free |

| Use Cases | Requires a formal application or fee | Personal records, research, informal verification |

| Request Process | Personal records, research, and informal verification | Can be copied or printed from public records |

Certified copies are considered official copies because they carry verification from the responsible office, such as the Miami County Auditor or Recorder. They are often requested for deeds, assessor records, and property tax documentation, ensuring that the information is accurate and recognized in legal or financial matters.

Fees, Processing Time, and Official Requirements

Requesting property record copies in Miami County typically involves modest fees, and the processing time can vary depending on the method used. Applicants must provide valid identification and complete the required forms to receive certified property record copies.

Public Records Request

When submitting a public records request, fees generally cover the cost of copying and certification. For example, a standard certified copy of a property deed or assessor record may cost between $5 and $15 per document, while multiple copies or large records could increase the total fee. Payment is usually accepted via cash, check, or money order at the Auditor’s or Recorder’s office.

In-Person Requests

Processing time depends on how the request is submitted. In-person requests are often completed the same day or within a few hours if the record is readily available. Mail requests typically take 7 to 14 business days, accounting for document retrieval, copying, certification, and postal delivery. Requests submitted online through official portals may be processed in 3 to 5 business days, depending on the office workload.

Applicants must meet official requirements to ensure successful retrieval. Required items usually include:

- Valid photo identification (driver’s license, state ID, or passport)

- Completed the request form specifying the record type and parcel number

- Payment for fees (if applicable)

- Notarization for certain certified copies, especially when legal verification is needed

Some property records, such as detailed assessor records or historical deeds, may require additional documentation or authorization if the requester is not the property owner. It is recommended to check with the appropriate office to confirm any unique requirements before submitting the request.

(FAQs) About Property Record Copies

Property record copies in Miami County are available to the public, although eligibility varies depending on the type of record. Certified copies typically take a few business days to process, and fees may apply depending on the requested document. These records include assessor documents, deeds, and tax information maintained by county offices. Knowing the correct office and type of copy helps ensure the request is handled efficiently. Proper preparation can save time and prevent delays in obtaining official records.

Can anyone request property records in Miami County?

Most property records can be requested by the public, including property owners, potential buyers, and legal representatives. Certain records, especially certified copies, may require proof of identity or a legal interest in the property. Miami County offices, such as the Auditor and Recorder, manage these requests to maintain accuracy and compliance. Requesters should verify property details and determine if a certified or uncertified copy is needed. Preparing the correct information ensures faster processing and fewer complications.

How long does it take to get certified copies?

Certified property record copies typically require 3 to 7 business days to process, though times may vary depending on the office workload. Online or in-person requests can sometimes be completed more quickly if all forms and information are accurate. Requests for deeds or tax records may take longer when additional verification or notarization is required. Allowing adequate processing time is important, especially for legal, financial, or real estate transactions. Planning helps avoid last-minute delays or complications.

Are there any fees for property record copies?

Fees are generally required for property record copies, with certified copies costing more than uncertified ones. Certified copies usually range from $5 to $10 per document, while uncertified copies may be $1 to $2 per page. Additional costs can apply for mail requests or expedited processing. Payments are accepted according to each office’s policy, including cash, check, or credit card. Submitting the correct fee ensures that requests are processed promptly and without unnecessary delays.

What is the difference between a certified and an uncertified copy?

A certified copy includes an official seal or signature confirming authenticity, making it valid for legal and financial purposes. An uncertified copy is a plain reproduction, suitable only for personal reference or research. Certified copies often take longer to process because of verification requirements. Knowing the difference helps users request the correct type of document for their needs. Selecting the proper copy type prevents delays in legal filings or property transactions.

How do I know which office has the records I need?

Miami County property records are maintained by different offices depending on the document type. The Auditor’s Office handles assessor records and tax history, the Recorder’s Office manages deeds and land transfers, and the Treasurer’s Office handles tax payments and delinquency information. Identifying the correct office before making a request ensures faster processing. Clear knowledge of office responsibilities helps users avoid unnecessary visits and ensures accurate public records retrieval.