Miami County property search provides fast, accurate access to property ownership, parcel details, tax records, and land information across the county. Using official Auditor and Recorder resources, users can check property history, view assessments, and examine GIS property maps for clear boundaries and neighborhood layouts. This tool supports homeowners, buyers, and investors with reliable data for decision-making. It also helps track property improvements, zoning information, and historical transfers, giving a complete picture of each parcel. With intuitive search options, users can quickly locate properties without confusion or delay.

Users can search by parcel number, property address, or owner name, each delivering precise property records and ownership details. GIS maps enhance the search experience by showing spatial relationships and property dimensions. With integrated property improvements, assessed values, and tax history, the Miami County Auditor’s Home provides a comprehensive hub for up-to-date property information. These resources also promote transparency for property taxes and valuations, helping residents plan or verify their holdings. Whether researching a single home or multiple parcels, the search tools make property data easy to access and understand.

What Is Miami County Property Search?

Miami County property search is the process of locating detailed information about properties within the county, including ownership, parcel data, and tax records. It provides residents, buyers, investors, and researchers with clear and organized property information that is publicly available. The Miami County Auditor and Recorder maintains official land records, which include ownership information, property classifications, assessed values, and tax history. These records are essential for verifying property details, understanding property taxes, and reviewing legal property descriptions. Most of the tools for property lookup are free to the public and can be accessed online through the Auditor’s or Recorder’s office.

Purpose and Benefits of Property Search

Conducting a property search in Miami County offers several key advantages:

- Ownership Verification: Confirms who legally owns a property.

- Property Tax Reference: Shows assessed values, tax due dates, and past payments.

- Parcel Details: Includes size, boundaries, zoning classification, and improvements.

- Land Records Access: Provides copies of deeds, surveys, and legal descriptions.

These benefits are valuable for potential buyers, real estate professionals, and anyone needing accurate property information for transactions, planning, or investment. For example, knowing a property’s assessed value helps anticipate tax obligations and budget accordingly.

Sources of Property Records

Property information in Miami County comes primarily from two offices:

- Auditor’s Office:

- Maintains parcel maps, assessed values, and property classification.

- Provides tools to search by address, owner name, or parcel number.

- Displays property improvements, exemptions, and tax history.

- Recorder’s Office:

- Stores deeds, mortgages, easements, and legal documents.

- Keeps historical records for land ownership and property transfers.

Together, these sources ensure that residents have access to comprehensive ownership info and parcel details. Many records are available digitally, allowing efficient property lookup without visiting the office in person.

Public Records Availability

Ohio law designates property records as public records, meaning anyone can view and use them for legitimate purposes. Users can:

- Check ownership information before purchasing a home.

- Research property boundaries using GIS maps.

- Verify tax records and outstanding balances.

- Obtain official copies of deeds or surveys if needed.

Most online tools provided by Miami County are free, accurate, and updated regularly. This ensures that anyone performing a property search can rely on official information without hidden fees.

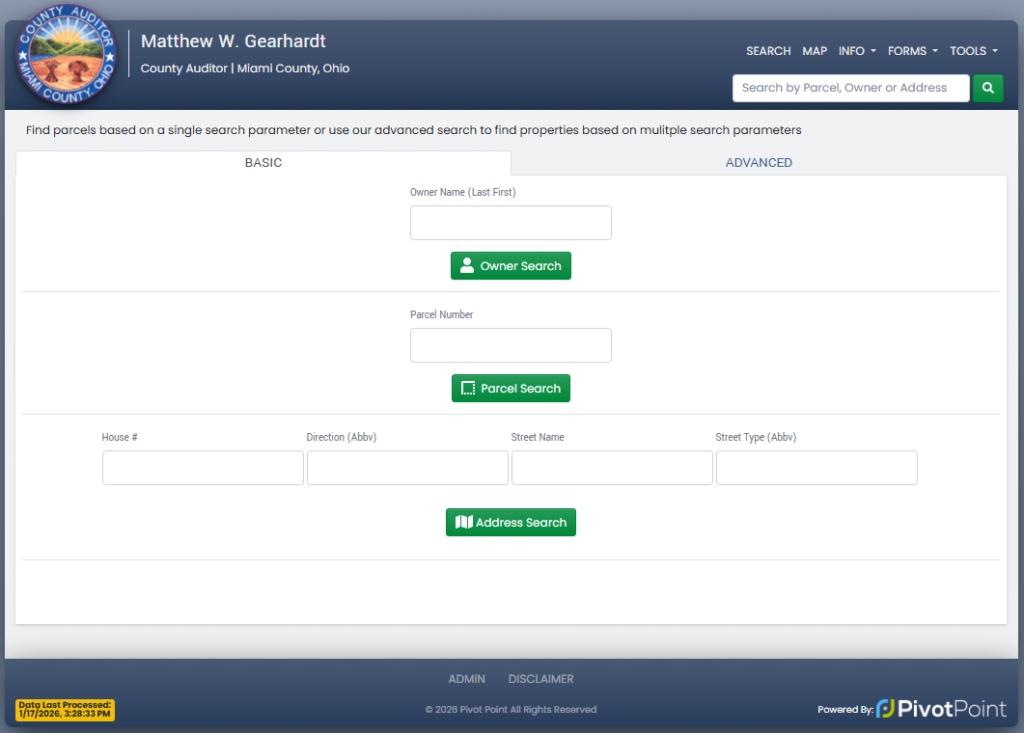

Miami County Property Search Tools

Miami County property search tools let users find detailed parcel details, ownership info, and land records directly from the official Auditor’s website. These tools support parcel search, address lookup, and owner name search, so anyone can quickly perform a Miami County property lookup or parcel search and view accurate property data. You can use the links below to go directly to the official property search portal and start your search right away:

Miami County Auditor Property Search Tool: https://www.miamicountyohioauditor.gov/Search

Search By Parcel Number

Searching by parcel number is the most precise way to find a specific property in Miami County. A parcel number is a unique numerical code tied to a single piece of land or real estate record. This makes it more accurate than searching by address or name, especially when similar property names or duplicate addresses exist.

To do a parcel search:

- Visit the official search page above.

- Choose “Search by Parcel Number.”

- Enter the full parcel number exactly as you have it.

- Click Search to view results.

- Review data such as ownership info and assessed values.

Parcel searches return detailed property records that include both land and improvement values, tax districts, and owner mailing addresses.

Example of Typical Fields Returned:

| Field | What It Means |

|---|---|

| Parcel Number | Unique ID for property records |

| Owner Name | Registered property owner(s) |

| Property Address | Street address of the parcel |

| Land Use | Classification (residential, commercial, etc.) |

| Market Value | Estimated market value of the property |

| Assessed Value | Taxable value assigned |

| Tax District | Relevant taxing authority |

Parcel number searches help users locate very precise ownership info and land records quickly, and they are especially useful for title work, property valuation comparisons, or legal documentation.

Search By Property Address

A property address search lets users look up Miami County property details when the parcel number is unknown. This is a common method used by homeowners, prospective buyers, and real estate professionals because addresses are easy to remember and generally unique.

How to do this search:

- Open the Miami County Auditor search tool (link above).

- Select “Search by Address.”

- Type in the street number and name.

- Hit Search to see results.

Common Information Shown:

- Owner name and mailing address

- Parcel number

- Legal description and land area

- Market and assessed values

- Taxing district info

Tips for Better Results:

- Enter the full street name with suffix (such as St, Ave, Rd).

- If the property is in a development, include the city or ZIP code.

- Use exact spellings to reduce mismatches.

This method gives a good balance of speed and accuracy for general property lookups and shows both ownership info and parcel details without needing a parcel ID.

Search By Owner Name

If someone knows the owner’s name but not the parcel number or address, this search option is useful. It returns all properties tied to that name in Miami County, which is helpful for research, investment decisions, or estate reviews.

Steps to Search:

- Pick “Search by Owner Name” in the search portal.

- Input the full name exactly.

- Click Search to see results.

Best Practices:

- Enter the full first and last name for precise matches.

- If the name yields many results, add city details to narrow them down.

- For business or trust names, try the legal entity name used on records.

Typical Results Include:

- Parcel numbers tied to the owner

- Property addresses and classifications

- Assessed and market values

- Sales and tax data

Owner name searches are particularly helpful when tracking multiple properties owned by the same individual or entity. Pairing this search with parcel numbers often gives the most complete picture of property holdings and values in Miami County.

How Miami County Property Records Are Organized

Miami County property records are structured to provide clear information about each parcel, including ownership, legal details, and assessed value. These records are maintained by different offices, each serving a specific purpose in managing property information. Property records in Miami County include parcel details, ownership info, tax records, and assessments. Parcel details identify the exact location, size, and legal description of a property. Ownership info indicates who holds title to the property, while tax records show any obligations or payment history. Assessments reflect the property’s current value for taxation purposes, helping ensure fair and accurate property taxes.

Parcel Records and Legal Descriptions

Each property in Miami County is assigned a unique parcel number, which links all records associated with that parcel. Parcel details often include:

- Lot size and acreage

- Property type (residential, commercial, agricultural)

- Street address and legal description

- Zoning classification

Auditor vs. Recorder Records

The Auditor’s Office focuses on property ownership info, assessments, and tax records. It tracks who owns a property and the assessed value for taxation. In contrast, the Recorder’s Office maintains the legal deeds and documents that prove ownership and record transfers. While the Auditor provides a current snapshot of property ownership and value, the Recorder preserves the historical and legal trail of transactions.

Assessments and Tax Records

Property assessments in Miami County are conducted annually. Each property’s assessed value determines the property tax owed. Tax records include:

- Current and past assessments

- Property tax history

- Exemptions or abatements

These records help property owners, buyers, and investors verify financial obligations. They also provide context for property valuations in real estate transactions.

Structured Data and Organization

Miami County organizes property records in a logical, searchable format, often linked to GIS property maps. These maps visually display parcel boundaries and property dimensions, making it easier to cross-reference information with physical locations. Structuring records this way allows users to combine ownership info, parcel details, and land records in a single view for accuracy and efficiency.

By combining the Auditor’s assessment data with the Recorder’s legal documentation, Miami County ensures transparency and reliability in property transactions. Users can access detailed information on ownership, parcel size, land records, and assessments, all connected through a consistent parcel reference system.

The Miami County GIS Property Map Tools

A GIS property map in Miami County shows detailed parcel boundaries, ownership information, and land features in a visual, interactive format. It helps property owners, buyers, and researchers quickly see property dimensions, zoning, and location details in one place.

GIS, or Geographic Information System, maps combine spatial data with property records. Unlike traditional paper maps, a parcel map displays individual property lines, land use classifications, and assessment details on an interactive digital platform. Users can identify adjacent parcels, street access, and key geographic features without visiting multiple offices.

Why GIS Property Maps Are Valuable

Property maps provide clarity and efficiency. They allow users to:

- View property boundaries accurately, including measurements and dimensions.

- Access land and ownership info without searching through multiple documents.

- Check zoning and parcel classifications for residential, commercial, or agricultural use.

- Visualize relationships between parcels, streets, and natural features.

These maps help in planning property purchases, estimating taxes, or researching potential land improvements. According to Miami County Auditor reports, GIS property maps are updated regularly to reflect recent changes in parcel ownership and property assessments, making them a reliable reference for public data.

Interpreting Miami County Parcel Maps

Reading a parcel map is straightforward once key elements are recognized. Key features include:

| Feature | What It Shows |

|---|---|

| Parcel Number | Unique ID for each property |

| Property Lines | Exact dimensions and shape of the lot |

| Ownership Info | Name of record owner(s) |

| Land Use Code | Type of property: residential, commercial, agricultural |

| Building Footprints | Locations of structures on the property |

| Zoning District | Classification affecting permitted use |

When viewing a GIS map, parcels are usually color-coded based on zoning or property type. Clicking on a parcel often reveals detailed property data, such as assessed value, acreage, and tax district.

How to Use the Miami County GIS Map Tools

- Open the Miami County Auditor GIS platform using your preferred browser.

- Enter a parcel number, property address, or owner name in the search bar.

- Click on a parcel to highlight it and view detailed data.

- Use zoom and layer tools to explore street views, topography, or floodplain overlays.

- Print or save maps for reference, including parcel dimensions and ownership details.

The interactive map also includes measurement tools that help calculate lot area or distances between property boundaries. For investors, homebuyers, and researchers, this allows quick comparisons between parcels and a clear visual context for property evaluations.

What Information You’ll Find in a Property Search

A Miami County property search provides a clear view of a property’s details, including ownership, land and building information, tax history, and parcel identifiers, giving users reliable data for legal, financial, or investment purposes.

Ownership Details

Ownership information identifies the legal owner(s) of a property, including individual owners, joint tenants, trusts, or corporate entities, and typically lists the mailing address for official correspondence, ownership type, and historical changes, making it easier to verify property history and link with parcel details and land records.

Parcel Number & Legal Identifiers

Every property has a unique parcel number or Property Identification Number (PIN) along with a legal description, such as lot, block, or subdivision, and a property classification like residential, commercial, or agricultural, which ensures precise searches and accurate access to maps, valuations, and public filings.

Land & Building Details

Property records describe the land and structures on it, including lot size, building type, square footage, number of bedrooms and bathrooms, and year built or renovations, often complemented by GIS maps that illustrate boundaries, topography, and nearby infrastructure, linking these details with ownership info and parcel data.

Assessed & Market Value

Assessed and market values provide the property’s current tax-assessed value alongside estimated market value and historical assessments, offering insights into taxation, investment potential, and property trends, while helping identify discrepancies or unusual changes over time.

Taxing Districts & Tax History

Tax records indicate the local districts responsible for levying property taxes, annual tax amounts, payment history, and any penalties, giving a full picture of a property’s financial obligations and connecting tax details with parcel identifiers and ownership information.

Sales & Transfer History

Historical sales and transfer records document previous ownership changes, sale dates, and purchase prices, allowing users to track market trends, property appreciation, and ownership legitimacy, complementing land records, parcel details, and ownership info for a complete property profile.

How To Obtain Official Copies & Certified Records

Obtaining official property records in Miami County can be done through several methods, including online, in-person, or by mail/email requests. Each option provides access to certified records with varying processing times and potential fees. Accessing an official record copy begins with deciding which office holds the desired documents. In Miami County, the Auditor’s Office maintains property-related records such as parcel details, assessed values, and ownership information, while the Recorder’s Office stores legal documents, including deeds, mortgages, and recorded plats. Knowing the distinction ensures requests are sent to the correct office and processed efficiently.

Online Downloads

The fastest way to obtain property records is through online portals provided by Miami County. The Auditor’s website allows users to view and download parcel records, ownership info, and tax data instantly. Many records are available in PDF format, suitable for printing or digital storage.

Benefits of online requests:

- Immediate access to current records

- No travel required

- Searchable by parcel number, property address, or owner name

Some official copies, particularly certified documents, may require payment via credit card. Online processing usually completes within minutes to a few hours, depending on the document type.

In-Person Requests

For certified record copies, visiting the office can be necessary. Both the Auditor and Recorder offices allow walk-in requests during regular business hours. Staff can assist in locating parcel records, deed copies, or recorded maps and verifying information on the spot.

Tips for in-person requests:

- Bring photo ID and relevant property details (parcel number or address).

- Check the office schedule to avoid long wait times.

- Prepare payment for certification fees, which typically range from $1 to $5 per page.

Processing is usually same-day, making this method ideal for urgent needs.

Mail or Email Requests

If an in-person visit is inconvenient, records can be requested via mail or email. Submit a written request including:

- Property details (address, parcel number, or owner name)

- Type of record needed (e.g., deed copy, ownership record)

- Payment information or a check for applicable fees

Processing times range from 5–10 business days, depending on document type and staff workload. Certified copies are mailed securely and may include tracking.

Fees & Processing Times

| Request Method | Typical Fee | Processing Time |

|---|---|---|

| Online Download | $0–$5 | Minutes to Hours |

| In-Person | $1–$5 per page | Same-Day |

| Mail/Email | $1–$5 per page + mailing | 5–10 Business Days |

Fees vary slightly between Auditor and Recorder offices, especially for certified copies. Non-certified versions are generally lower in cost and faster to obtain.

Auditor vs Recorder Differences

| Office | Records Maintained | Typical Use |

|---|---|---|

| Auditor | Parcel records, assessed values, property ownership, tax history | Property lookup, valuation research, assessment review |

| Recorder | Deeds, mortgages, plats, liens | Legal verification, title searches, official certified copies |

The office holds the needed record ensures a smooth and accurate request. Most users require a combination of both to complete full property research or legal verification.

Common Property Search Uses

Miami County property search tools are widely used for several practical purposes. Residents, buyers, and professionals rely on these resources to obtain accurate ownership info and land records efficiently. Property searches provide valuable details about parcels, property history, and legal documentation. These insights serve a variety of needs, from real estate transactions to legal verification. Using the Miami County property search ensures that users access updated and reliable data directly from county records.

Buying and Selling Homes

When buying or selling a home, accurate property information is critical. A property search reveals ownership info, parcel dimensions, zoning classifications, and tax history. This data helps buyers confirm property boundaries, understand previous sales, and evaluate market value. Sellers can use property records to prepare disclosures, verify ownership, and ensure all legal requirements are met before listing a home.

A complete property report may include:

- Parcel number and property address

- Legal descriptions and lot size

- Past sale prices and property valuation trends

- Property tax history and current liens

Such records support transparent transactions and reduce the risk of disputes.

Title Research

Title research relies on detailed land records to trace ownership history. Property search tools allow title companies, attorneys, and potential buyers to verify the chain of title, check for easements, and identify liens or encumbrances.

A thorough title review includes:

- Names of past and present owners

- Deeds and transfers

- Mortgage and lien records

- Easement or right-of-way information

Accurate title research ensures clarity in ownership rights and prevents legal conflicts during property transfers.

Property Tax Assessment Appeals

Property owners can reference parcel and tax records when preparing for assessment appeals. Detailed ownership info and valuation history help identify discrepancies between assessed and actual property value.

Key points for appeals include:

- Historical property valuations

- Comparisons with similar properties

- Tax payment history and exemptions

Access to precise records can improve the chances of correcting errors or adjusting assessments fairly.

Legal and Deed Verification

Legal professionals frequently use property searches to confirm ownership and verify deed information. Complete land records indicate property boundaries, easements, and any restrictions tied to a parcel.

Verification typically involves:

- Confirming deed authenticity and signatures

- Checking for property disputes or claims

- Reviewing recorded covenants or restrictions

Having accurate documentation ensures that all property rights and obligations are clear for buyers, sellers, and legal entities.

Miami County Property Tax Records & Search

Property tax records in Miami County are closely connected to property search tools, allowing residents to verify ownership, track assessments, and manage tax responsibilities efficiently. Tax information can be reviewed through online databases or the Auditor’s office, providing accurate and up-to-date details. Miami County property searches often include tax records, which show the amount owed, payment history, and applicable penalties. These records help homeowners, buyers, and investors evaluate the financial status of a property before making decisions. Using property search tools, users can locate tax data by parcel number, property address, or owner name, making it easier to monitor obligations and verify legal information.

How Tax Records Integrate With Property Search

Miami County property search platforms consolidate multiple types of information in one place. When a property is searched:

- Ownership info appears alongside parcel details.

- Property assessments show the current valuation used to calculate taxes.

- Tax records indicate annual obligations, past payments, and delinquent balances.

For example, entering a property’s parcel number returns both its assessed value and related tax history, linking directly to public records. This integration ensures users see a complete picture of the property, combining legal, financial, and geographic data, including GIS parcel maps.

Viewing Tax Due Dates and Penalties

Miami County tax records specify payment schedules and consequences for late payments. Key points include:

- Due Dates: Real estate taxes in Miami County are typically split into two installments per year.

- First half: Usually due in January

- Second half: Usually due in July

- Penalties: Late payments may incur interest and additional fees, which continue to accumulate until payment is made.

A property search by owner name or address displays both current and past tax records, making it easier to plan for upcoming payments. Additionally, some records highlight whether a property has unpaid balances or liens, which is critical for potential buyers and real estate professionals.

How To Appeal Property Assessment in Miami County

Property owners in Miami County who believe their property has been assessed at an incorrect value can formally appeal the assessment. The appeal process allows homeowners and investors to challenge their property’s valuation and ensure fair property taxes. Property assessments determine the taxable value of a home, land, or commercial property. If the assessed value seems too high, it can significantly increase property taxes. Miami County provides a clear process for property owners to submit appeals to the Board of Revision, ensuring property values reflect accurate market conditions.

Steps to Appeal Property Assessment

- Review Your Property Assessment Notice

- Property owners receive an annual assessment notice showing the property’s current valuation.

- Compare the assessed value with recent sales of similar properties in your area.

- Collect documents such as appraisals, photographs, or repair estimates to support your case.

- Complete the Appeal Form

- The official appeal form is available from the Miami County Auditor’s Office.

- Fill in your property details, including parcel number, owner name, and current assessment.

- Clearly state the reason for appealing the valuation.

- Submit the Appeal Within the Deadline

- Deadlines are set annually, often within 30 to 60 days of receiving the assessment notice.

- Appeals must be submitted on time to be considered. Late submissions are generally rejected.

- Attend the Board of Revision Hearing

- Once submitted, a hearing is scheduled before the Board of Revision.

- Present your evidence, including comparables, appraisals, or photos showing property issues.

- Board members may ask questions to clarify your claim.

- Receive the Decision

- After review, the Board of Revision issues a written decision adjusting or confirming the assessment.

- If the assessment remains higher than expected, property owners may have the option to appeal further to the state-level tax tribunal.

FAQs — About Property Search

Miami County property search raises common questions for homeowners, buyers, and investors, and this section answers them with clear, actionable information.

What is a property search, and is it free?

A property search is the process of accessing property records, including ownership info, parcel details, and land records, to verify property ownership, tax history, and assessed values. In Miami County, basic property searches are free using official auditor tools, though certified copies or detailed reports may require a small fee, and users can perform searches by parcel number, address, or owner name to find accurate and updated property information.

How often are records updated?

Property records in Miami County, including ownership info, parcel details, and land records, are updated regularly to reflect changes from property sales, assessments, or new construction, with official records refreshed multiple times per year so users can rely on them for accurate tax, zoning, and valuation information.

Where can I find GIS parcel maps?

GIS property maps provide visual representations of property boundaries, lot dimensions, and geographic features, and Miami County offers GIS tools where users can view interactive parcel maps linked to ownership info, land records, and zoning classifications to support research, investment, or planning decisions.

How can I check tax delinquencies?

Tax delinquencies show whether property taxes are unpaid, and Miami County property search tools display detailed tax records, including current and past due amounts, assessed values, and penalties, allowing users to review parcel details, ownership info, and financial obligations before buying, selling, or managing property.

Can I get certified copies online?

Certified property record copies, including deeds, surveys, and tax documents, verify official ownership info and parcel details, and Miami County allows online or in-person requests for such documents, with fees depending on certification type, ensuring legal or transactional needs are met with accurate land records.