Miami County property taxes are due twice a year, and each payment supports local services like schools, roads, and emergency response. The county issues a tax calendar that lists exact payment deadlines for the first and second halves of the year. Missing a deadline triggers penalty charges and interest, which accumulate over time. Homeowners receive official notices with the property tax schedule, helping them track upcoming due dates and avoid additional fees. Staying informed about these payment dates ensures all obligations are met without complications.

Property owners should also pay attention to credits and exemptions, including the homestead exemption and owner-occupancy credit, which reduce taxable amounts when submitted correctly. According to the Miami County Ohio Auditor, understanding these credits and the overall tax structure is essential for accurate financial planning. The payment timeline allows residents to plan and divide annual taxes into manageable installments. Awareness of late payment consequences encourages timely action and prevents delinquent status. Following the Miami County property tax schedule keeps accounts current, helps maintain financial control, and ensures full compliance with county regulations. Residents who track the tax calendar and monitor penalty dates, as advised by the Miami County, Ohio, Auditor, experience fewer surprises and smoother property management throughout the year.

How Miami County Property Taxes Are Calculated and Paid

Property taxes in Miami County are collected to fund local services such as schools, roads, and public safety. These taxes follow a clear annual cycle and are typically paid in two installments each year, known as semi-annual payments. Residents receive tax bills based on the assessed value of their property, which the county auditor determines. The property tax cycle starts with the valuation of land and structures, followed by the calculation of the total tax owed. This amount is then divided into semi-annual payments, making it easier for property owners to manage their finances.

The property tax schedule in Miami County is set by law, and each installment comes with a specific payment deadline. Paying on time helps residents avoid additional fees or penalty dates that can accumulate quickly. The first half of the annual tax is usually due in January, while the second half is due in July, though dates can vary slightly each year.

- How property taxes are calculated:

- The county auditor assesses the property value.

- Local tax rates are applied to the assessed value.

- Any exemptions or credits, such as homestead or owner-occupancy credits, are subtracted.

- The final amount is split into two semi-annual payments.

Residents should track the property tax payment dates in Miami County to ensure timely payments. The county often sends reminders, and many taxpayers mark the tax calendar to keep payments on schedule. Using a checklist or calendar can help avoid missed deadlines, late fees, or delinquent status.

How to Pay Your Property Taxes

Paying property taxes in Miami County is straightforward and can be done through multiple payment methods. Residents can choose online, mail, or in-person options according to their convenience and tax payment schedule. Property owners should follow the property tax payment dates in Miami County to avoid late fees or penalties. The county provides clear instructions for each payment method. Understanding the options can help ensure taxes are submitted on time and accurately.

Online Payment

Online payment offers a fast and secure way to meet your tax obligations. Residents can use the official Miami County Treasurer website to complete payments for both the first and second half of their property taxes.

Key points about online payment:

- Payments can be made using credit/debit cards or bank transfers.

- Confirmation receipts are typically provided immediately after submission.

- This method aligns directly with the tax payment schedule, reducing the risk of missed deadlines.

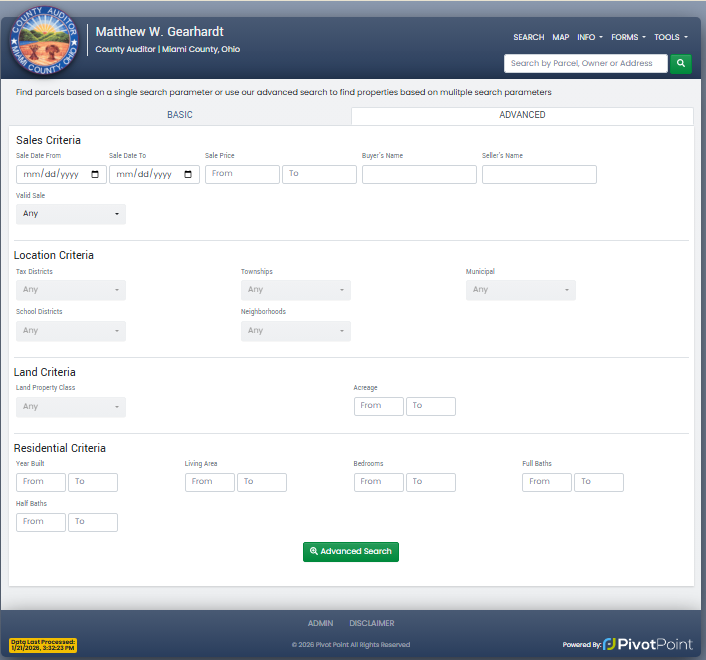

For official online payments, residents should use the Miami County Treasurer’s online payment tool: https://www.miamicountyohioauditor.gov/Search. Online payment is especially useful for those who want to ensure taxes are recorded promptly and reduce paperwork.

Payment by Mail

Paying by mail is a traditional option that allows residents to submit checks or money orders. This method requires attention to the mailing address and deadlines to ensure timely processing.

Steps for mail payment:

- Prepare a check or money order made payable to the Miami County Treasurer.

- Include the tax bill or property parcel number on the payment for proper allocation.

- Mail the payment to:

Miami County Treasurer

201 W. Main St.

Troy, OH 45373

- Allow sufficient mailing time to meet the property tax payment dates in Miami County.

Using mail payment requires planning to avoid late submission. Postmarks on the payment are generally considered when determining timeliness.

In-Person Payments

Residents can also pay property taxes directly at the Treasurer’s office. This method allows for immediate processing and provides an opportunity to ask staff questions regarding the tax payment schedule.

Details for in-person payments:

- Location: Miami County Treasurer’s Office, 201 W. Main St., Troy, OH 45373

- Accepted payment types: cash, check, money order, or card (verify card acceptance in advance)

- Office hours: Monday through Friday, typically 8:00 a.m. – 4:30 p.m.

In-person payments are often preferred by residents who want confirmation of receipt immediately and the reassurance that the payment has been properly applied.

Key Property Tax Payment Dates

Miami County property taxes are typically split into two installments each year. The first and second half payments follow a fixed schedule with clearly defined deadlines, and missing these dates can result in late fees and interest. Property owners should be aware of these deadlines to plan their finances effectively and avoid penalties. A clear tax calendar helps residents track the payment timeline for each installment. Below is a detailed explanation of the key property tax dates and related payment information.

First Half Payment

The first installment of property taxes is generally due in January. This payment covers the first half of the annual property tax amount assessed by the Miami County Auditor. The payment deadline usually falls in mid-February, and payments received after this date may incur a late fee and interest charges.

Points for the first half payment include:

- Covers 50% of the annual property tax

- Due Date: Mid-February (check the official Treasurer site for the exact date each year)

- Late Fees: Interest accrues on unpaid amounts from the day after the deadline

- Payment can be made online, by mail, or in person at the Miami County Treasurer’s office

First Half Payment Schedule Table:

| Installment | Due Month | Deadline | Late Fee/Interest |

|---|---|---|---|

| First Half | January | Mid-February | Interest applies after the due date |

| Second Half | July | Mid-August | Interest applies after due date |

Paying the first installment on time ensures the property remains in good standing and prevents delinquency. The tax payment timeline is designed so residents have six months to manage each installment.

Second Half Payment

The second installment is generally due in July, covering the remaining portion of the annual property tax. The payment deadline typically occurs in mid-August, and similar to the first half, late payments will accrue interest and may include additional penalties.

Considerations for the second half payment:

- Covers the remaining 50% of annual property taxes

- Due Date: Mid-August (exact dates vary yearly)

- Late Fees: Interest calculated from the day after the deadline until paid

- Multiple payment options are available, including online, mail, and in-person submission

Tips to follow the second half payment schedule:

- Mark your calendar with the payment deadline

- Set reminders for the mid-August due date

- Confirm payment receipt with the Treasurer’s office if paying close to the deadline

Maintaining timely payments for both halves keeps the property tax account current and avoids escalation to delinquent status. Residents can use a tax calendar to monitor both installment deadlines and align payments with their personal budgeting schedule.

Penalties for Late Property Tax Payments

Late property tax payments in Miami County can result in interest charges and additional penalties. Missing the payment deadline may also place a property into delinquent status, triggering further consequences. Property owners should be aware that the county applies structured penalty dates to unpaid taxes, and interest accrues on balances that remain overdue. Staying informed about these timelines helps residents avoid unexpected costs and potential legal complications.

Interest Charges

Interest is applied to any unpaid property taxes starting from the day after the payment deadline. In Miami County, the interest rate typically ranges from 1.5% to 18% annually, depending on how long the taxes remain unpaid. The county calculates interest on a monthly or daily basis, compounding the amount owed over time.

For example, if a property tax bill of $2,000 remains unpaid for two months past the due date, the interest added could range from $25 to $60, depending on the current interest rate. These interest charges are added directly to the delinquent balance until full payment is made.

Additional Penalties

Beyond interest, the county may impose penalties if taxes remain unpaid after certain deadlines. These late payment consequences include fixed fees or escalating percentages added to the original tax amount. Penalties can be applied in stages, increasing the total amount owed as time passes.

Penalty Timeline Example:

| Period Past Due | Penalty Applied | Notes |

|---|---|---|

| 1–30 days | 2% of unpaid taxes | Initial penalty |

| 31–60 days | Additional 3% | Total 5% penalty |

| Over 60 days | Additional 5% | Total 10% penalty, possible delinquent status |

These additional penalties emphasize the importance of monitoring penalty dates and ensuring payments are made promptly. Residents should note that penalties are applied per installment, meaning late first-half payments and second-half payments can each incur fees.

Avoiding Delinquent Status

Property taxes that remain unpaid for extended periods may enter delinquent status, which can lead to legal actions, public notices, or property liens. Avoiding delinquency requires careful attention to property tax reminders and payment schedules.

Tips to Avoid Delinquent Status:

- Review the tax calendar at the start of the year to mark all payment deadlines.

- Set personal reminders before the due dates to ensure timely payments.

- Contact the Miami County Treasurer if assistance or clarification is needed regarding a balance.

- Consider splitting payments for semi-annual installments to manage cash flow effectively.

Staying proactive reduces the risk of escalating late payment consequences and ensures compliance with county requirements. Property owners who follow the official property tax schedule can prevent interest accrual and avoid additional penalties.

(FAQ) About Property Tax Due Dates

Miami County property taxes are generally due in two installments each year. Residents should follow the official tax calendar and payment schedule to avoid late fees. This section answers common questions about when property taxes are due, penalties, and payment methods.

When are Miami County property taxes due?

Property taxes in Miami County usually follow a semi-annual schedule, with the first half due in January and the second half in July. Exact dates can change each year according to the official tax calendar, so checking the Treasurer’s website is recommended. Staying aware of these payment deadlines helps residents avoid late fees and interest charges, keeping taxes current and on track.

What happens if I miss a payment deadline?

Missing a property tax deadline results in penalties and interest charges on the unpaid amount. Over time, these costs can increase, and the property may be recorded as delinquent. Following the official payment schedule and setting reminders can help prevent additional fees and ensure taxes are paid on time.

How is interest on late payments calculated?

Interest accrues from the original due date until the taxes are paid. Miami County applies a monthly interest rate to overdue balances, which can grow quickly if left unpaid. Understanding the penalty dates and staying aware of the tax calendar can help residents manage their payments and avoid extra charges.

Can I pay my property taxes online?

Residents can pay taxes online through the official Treasurer website, or they can pay by mail or in person at designated offices. All methods follow the same Miami County property tax due dates, and using online services can help track the payment schedule efficiently. Online payment also reduces the risk of missing deadlines.

What is a delinquent property tax?

A property tax becomes delinquent when it is not paid by the scheduled due date. Delinquent taxes may incur additional interest and penalties, and official notices are sent to property owners. Following the payment schedule and checking the tax calendar regularly helps residents avoid delinquency and maintain compliance.