Searching for property in Miami County by its street address is the fastest and most precise way to access ownership details, property valuation, and tax records. The Miami County property search by address tool allows homeowners, real estate investors, and professionals to quickly locate properties without needing a parcel number or owner name. By using this method, users can view comprehensive information, including parcel ID, property location, assessed values, and legal ownership records, directly on the official Miami County Auditor portal.

The Miami County Auditor’s Home serves as the central hub for property information in the county, offering a reliable property address lookup that saves time and reduces errors compared to other methods. With just a street address search, users can instantly access property details, including lot size, building data, classification (residential, commercial, or agricultural), and tax history. Whether reviewing a home’s valuation, checking property records for investment purposes, or confirming ownership for legal matters, the Miami County Auditor’s Home ensures accurate and up-to-date information, making it an essential resource for anyone handling real estate in Miami County.

What is Miami County Property Search by Address?

Miami County Property Search by Address is an online tool that allows users to locate property information using a street address instead of an owner’s name or parcel number. It provides direct access to property details, tax data, and ownership records quickly and accurately.

This tool simplifies the process of obtaining property records for residents, buyers, investors, and professionals. Unlike searching by owner name, which can produce multiple results or require exact spelling, or searching by parcel PIN, which is often only known to current owners or officials, the address search allows anyone to pinpoint the correct property with minimal effort.

The Miami County Auditor search is the official source for property information. It includes comprehensive data such as:

- Parcel ID Lookup: Each property has a unique parcel identification number for precise tracking.

- Ownership Records: Current owner names and transfer history.

- Property Valuation: Land value, building value, and total assessed value.

- Property Details: Lot size, building type, square footage, and year built.

Using the property address lookup, users can enter the street number and name to see full details without needing additional identifiers. Partial addresses are often sufficient, making searches flexible and user-friendly.

Steps to Search Property by Address

Searching for property in Miami County by address is quick and accurate. Users can find ownership details, valuation, tax information, and parcel data within minutes. Here’s a detailed walkthrough for conducting a https://www.miamicountyohioauditor.gov/Search Miami County property search by address, including tips, examples, and a sample results table.

Visit the Miami County Auditor Website

Start by opening the Miami County Auditor’s official website. This platform hosts all real estate records for the county, making it the most reliable source for property data. The site’s layout is straightforward, and the property search tools are easy to locate.

Tips:

- Use a modern web browser for the best performance.

- Look for the “Real Estate Search” or “Property Search” section on the homepage.

- Bookmark the page for future reference, especially for recurring property lookups.

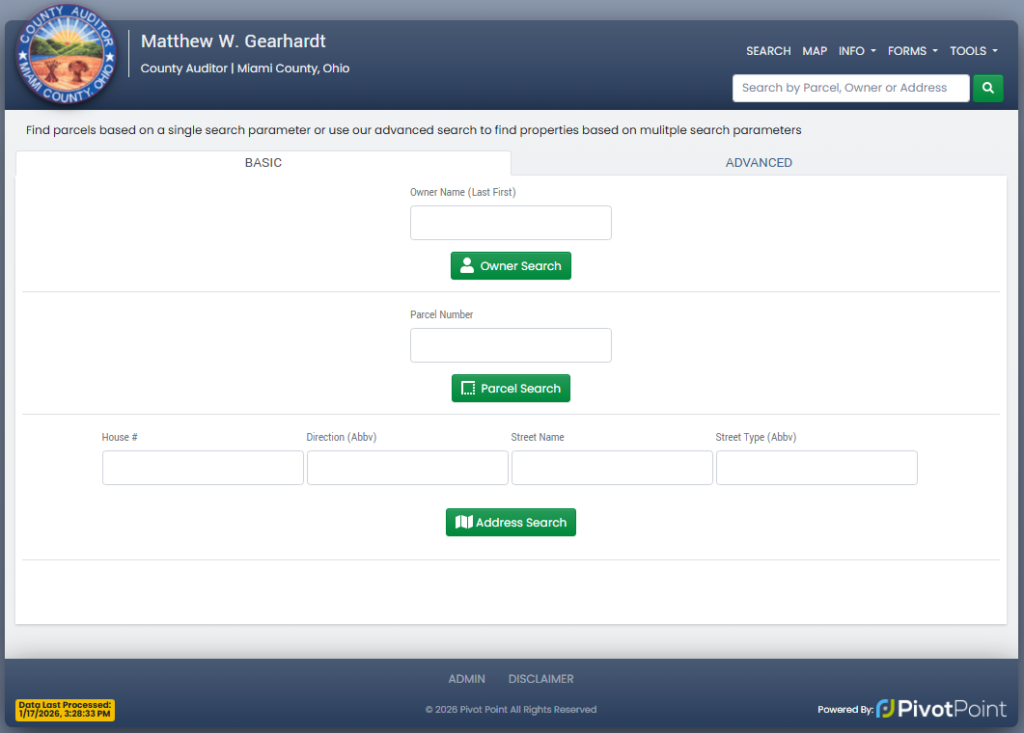

Select “Search by Address”

Once in the property search section, choose the “Search by Address” option. This method is often faster than searching by owner name or parcel number because it allows users to input a physical street address directly.

Key points for accuracy:

- The search form usually asks for a street number and street name.

- Partial addresses are often accepted, such as “123 Main” instead of “123 Main Street.”

- Avoid unnecessary punctuation to prevent errors.

Selecting the address search ensures the system returns property-specific results, including ownership, valuation, and tax information linked to the entered location.

Enter the Street Address Correctly

Entering the address correctly is crucial for accurate results. The system can handle common abbreviations like “St” for Street or “Rd” for Road, but consistent formatting reduces errors.

Tips for entering addresses:

- Use numeric street numbers (e.g., 201 instead of Two Hundred One).

- Omit punctuation marks (e.g., 201 Main St, not 201 Main St.).

- Include the city if prompted; it helps refine results for streets shared across multiple towns.

- Partial addresses may return multiple matches—review carefully.

This step directly affects the speed and accuracy of the search. Mistyped or incomplete addresses might return no results or multiple entries.

Review and Select Property from Search Results

After entering the address, the system generates a list of matching properties. Carefully review the results to identify the correct property. This list typically includes:

- Property Address

- Owner Name

- Parcel ID

- Property Type

Table of Search Results:

| Property Address | Owner Name | Parcel ID | Property Type | Market Value |

|---|---|---|---|---|

| 1234 Main St, Troy, OH | David R. Thompson | K10-021500 | Residential Dwelling | $278,900 |

| 456 Oakwood Dr, Tipp City, OH | Linda & Mark Stevens | L12-009300 | Single-Family Home | $325,400 |

| 890 Peters Rd, Piqua, OH | Weston Properties LLC | M07-114200 | Commercial Building | $910,000 |

Information You Can Find Using an Address Search

Searching for a property by address in Miami County provides a clear and detailed view of ownership, property characteristics, valuation, and tax information. This method quickly connects users with official records, making it easier to verify ownership and assess property data accurately.

Ownership & Legal Data

When performing a parcel by address search, users gain access to comprehensive ownership and legal details. This includes:

- Current Owner Name(s): Full legal names of property owners.

- Transfer Dates: Dates of ownership changes recorded with the county.

- Deed References: Links to deed documents and official filings.

- Legal Notes: Any relevant easements, restrictions, or recorded liens.

These records are valuable for property ownership verification, whether for personal, investment, or legal purposes. Each entry comes directly from the Miami County Auditor’s database, ensuring accuracy. For investors or attorneys, these details can confirm property legitimacy and track historical ownership changes.

Property Details

An address search also reveals the key physical characteristics of a property, providing insight into its use and size. Typical details include:

- Parcel Number (PIN): Unique identifier for the property.

- Property Type: Residential, commercial, agricultural, or mixed-use.

- Lot Size and Acreage: Total land area, often in acres or square feet.

- Year Built: Construction year of main structures.

- Building Square Footage: Total living or usable space.

Including these details makes it easier to evaluate property suitability, compare locations, and understand zoning or development potential. Property location data is essential for buyers, real estate agents, and municipal planning purposes.

Valuation Information

Address-based property searches also provide detailed valuation data, which helps assess market and tax value. Key valuation elements include:

- Land Value: Market value of the land alone.

- Building Value: Estimated value of structures on the property.

- Total Assessed Value: Combined land and building value used for taxation.

- Last Reappraisal Year: Indicates when the property was last assessed for tax purposes.

These figures allow users to analyze investment opportunities, property taxes, or historical valuation trends. Assessed value data is critical for calculating potential property tax liabilities.

Tax Records

Tax records are fully integrated with property information and can be reviewed directly by address. Users can view:

- Annual Property Taxes: Amount due each year based on assessed value.

- Taxing Districts: City, township, village, and school district assignments.

- Payment Status: Shows paid, unpaid, or delinquent taxes.

- Delinquent Tax Details: If applicable, outstanding balances and penalties.

Miami County property tax history offers transparency for buyers, real estate professionals, and financial planners. Users can see property tax history at a glance and compare values across years or districts.

Sample Address Search Result

| Property Address | Owner Name | Parcel ID | Property Type | Market Value | Taxes Due |

|---|---|---|---|---|---|

| 1234 Main St, Troy, OH | David R. Thompson | K10-021500 | Residential Dwelling | $278,900 | $3,755 |

| 456 Oakwood Dr, Tipp City, OH | Linda & Mark Stevens | L12-009300 | Single-Family Home | $325,400 | $4,142 |

| 890 Peters Rd, Piqua, OH | Weston Properties LLC | M07-114200 | Commercial Building | $910,000 | $11,455 |

How Property Taxes Work in Miami County, Ohio

Property taxes in Miami County are calculated based on a property’s assessed value and the local tax rate. Searching for property taxes by address allows homeowners, buyers, and investors to see accurate tax amounts and understand how their payments are determined.

How Property Tax Is Calculated

Miami County calculates property taxes using the assessed value of a property, which is typically 35% of the market value. The assessed value is then multiplied by the local millage rate to generate the annual tax bill. This method ensures that properties are taxed fairly according to their size, type, and value.

Example Calculation:

- Market Value of Property: $300,000

- Assessed Value = 35% of $300,000 = $105,000

- Local Millage Rate = 1.35%

- Annual Property Tax = $105,000 × 0.0135 = $1,417.50

Property valuation in Miami County includes both land and building value, and the assessor updates these figures every three years as part of the county reappraisal cycle. Tax records by address reflect these calculations, allowing users to verify current and past tax amounts.

Tax Rates by City, Township, and Village

Miami County’s tax rates vary depending on location. Cities typically have higher rates than townships due to municipal services. Villages generally fall between cities and townships. The following table provides an overview of average effective tax rates in different areas:

| Area Type | Jurisdiction | Average Effective Tax Rate |

|---|---|---|

| City | Troy | 1.35% |

| City | Piqua | 1.42% |

| City | Tipp City | 1.28% |

| City | Sidney (partial) | 1.30% |

| Township | Concord | 1.10% |

| Township | Newton | 1.15% |

| Township | Lostcreek | 1.05% |

| Township | Springcreek | 1.12% |

| Village | Covington | 1.38% |

| Village | Pleasant Hill | 1.33% |

| Village | West Milton | 1.29% |

These rates apply to both residential and commercial properties, but special levies or school district taxes can adjust the final bill. Using a property record search online ensures accurate and current information for any address in Miami County.

Payment Schedule and Methods

Property taxes in Miami County are typically billed semi-annually. The schedule is as follows:

- First Half: Due in January

- Second Half: Due in July

Late payments incur interest charges, and penalties increase over time. Payment methods are designed for convenience, including:

- Online payment through the Miami County Auditor portal

- Mailing a check to the county office

- In-person payment at the Auditor’s office

Maintaining up-to-date property tax payments is important for avoiding delinquency and ensuring clear records of ownership. Tax records by address can also help property buyers verify outstanding amounts before purchase.

Fees Associated with Property Search & Records

Searching property records in Miami County is mostly free, but certain documents and certified copies may require a small fee. Online property address lookup and parcel searches cost nothing, making it easy to access official information quickly. Miami County provides free access to official property records and real estate records Miami County through its online search portal. Users can enter a street address, owner name, or parcel number to view ownership details, valuation, and tax history without any charge. This ensures that homeowners, buyers, and real estate professionals can obtain key property information efficiently.

While online searches are free, requesting physical or certified copies may incur costs. Common fees include:

- Certified Property Record: Small per-document fee for legal or official use.

- Deed Copies: Charged per page if a notarized or certified copy is required.

- Tax Bill Copies: Usually free online; printed versions may have a minimal fee.

Most of the property-related forms, such as ownership change requests or transfer documents, can also be submitted at no cost. Using the free online portal for property address lookup or parcel by address searches is often sufficient for casual research or routine verification.

Required Forms

To complete certain actions related to the Miami County property search, specific forms are necessary. These forms ensure accurate records for property ownership, valuation, and mailing information. The most commonly used forms include the Real Property Transfer Form, the Board of Revision Form, and the Homestead Exemption Application. These documents allow property owners and interested parties to make official updates or corrections to the county’s property database.

Real Property Transfer Form (DTE 100)

This form is used whenever property ownership changes. Filing it ensures the county records reflect the correct owner and legal transfer date. Accurate filing prevents future discrepancies in ownership records and supports proper tax assessment.

Board of Revision Form (Valuation Complaint)

Property owners who believe their property’s assessed value is incorrect can submit this form. It allows for formal review and potential adjustment of the property’s valuation, ensuring fair taxation. The process is especially relevant for homes, commercial buildings, or parcels where the market value has changed significantly.

Homestead Exemption Application

Residents who qualify for the homestead exemption can reduce the taxable property value on their primary residence. This form requires proof of residency and ownership and can result in significant savings on annual property taxes.

Update Frequency for Property Records

Property records in Miami County are updated regularly to reflect ownership changes, property valuations, and tax payments. Users can trust that information from the Miami County Auditor search is current and accurate for most practical purposes. The ownership of a property is updated soon after a deed is officially recorded with the county. This means any sale, transfer, or legal change in ownership will appear in the system, making it easy to confirm the current owner through a parcel by address search.

Property valuations follow Ohio’s three-year reappraisal cycle, with minor annual adjustments in between. These updates ensure that the assessed value accurately reflects the property’s market conditions. Tracking valuation changes can help homeowners, investors, and real estate professionals stay informed about tax liabilities and property worth. Tax payment records are refreshed after each billing cycle. Payments made online, by mail, or in person are recorded promptly, showing whether taxes are current or delinquent.

Common Problems & Solutions

When using the Miami County property search by address, users may occasionally encounter incorrect information in the records. Common issues include wrong owner names, inaccurate property values, or mailing address errors, and each can be resolved through clear steps.

Incorrect Owner Name

An incorrect owner name in property records can confuse buyers, investors, or legal matters. To correct this, property owners should:

- Verify the Deed: Check the recorded deed at the Miami County Auditor’s office to confirm the correct ownership.

- File an Ownership Correction: Submit a written request or form to update the record. Include proof of ownership, such as a deed or title document.

- Monitor Updates: Once processed, check the official property search portal to confirm the correction.

Wrong Property Value

Property valuations may sometimes appear incorrect in the system. This can affect tax bills or resale value. To address this:

- Review Assessment Records: Compare the property’s assessed value with similar parcels in the same neighborhood.

- File a Valuation Complaint: Use the Board of Revision form to dispute the assessed value officially. Include supporting documents like appraisals or recent sales data.

- Follow Up: Reassessments usually take effect after review, and changes will reflect in both the ownership records and property tax history.

Using parcel by address searches helps verify current valuations and ensures transparency.

Mailing Address Errors

Incorrect mailing addresses can lead to missed tax notices or legal correspondence. To fix this:

- Submit an Address Update Form: Available from the Miami County Auditor’s office, this form updates the official records.

- Double-Check Entries: Confirm the property’s street address matches the record used in the property search.

- Confirm Changes Online: After processing, use the property ownership verification tool to ensure the updated address appears correctly.

Advantages of Searching for Property by Address

Searching for property by address in Miami County is often faster and more accurate than other methods. Users can access ownership records, property details, and tax information without needing a parcel ID or owner name. Using the property address lookup provides a clear and direct way to pinpoint a specific real estate address. This method ensures that results match the exact location, reducing errors that can occur with name searches. It is particularly helpful for buyers, investors, and professionals who need precise property information quickly.

Key Benefits of Searching by Address:

- Faster results: Entering a street address provides immediate listings without scrolling through multiple owner names.

- No parcel ID required: Users can search even if they do not know the parcel identification number.

- Accurate ownership records: The system links directly to official Miami County Auditor data, including deed references and transfer dates.

- Comprehensive property details: Land size, building dimensions, year built, and property classification are all available.

- Clear property location verification: Confirms exact property boundaries and location within the county.

For real estate professionals, investors, and homeowners, this method simplifies the process of checking property values and tax history. By entering a street address, users gain access to precise and official property information without confusion.

(FAQ) About Property Search by Address

Finding property details in Miami County is simple when using the official search tools. The following frequently asked questions explain how to search by address, what information is available, and tips for resolving common issues, helping homeowners, buyers, investors, and professionals access accurate property records quickly.

How to search property by address in Miami County?

Searching for property by address in Miami County is straightforward and efficient. Users can enter a street number and name on the official Miami County Auditor website to access complete property records. The search provides detailed ownership information, parcel ID, assessed value, and tax history, and partial addresses can also return results, making it convenient for homeowners, investors, real estate agents, or attorneys who need accurate property location information quickly.

Is the property search free?

Yes, Miami County property search by address is completely free when conducted online through the auditor’s portal. Anyone can view ownership details, valuation information, and property tax history without paying any fees. Charges only apply when requesting certified copies or official printed documents, but basic access to property location, parcel by address details, and tax information remains fully cost-free, providing a convenient way to check real estate records without delay.

What information is available using the address search?

A property search by address in Miami County provides comprehensive information for every parcel. Users can see ownership details, including current owner names and deed references, property characteristics such as lot size, acreage, building square footage, year built, and property classification, as well as valuation data, including land value, building value, total assessed value, and annual property taxes. This makes it easy to access complete property location details and ownership records, giving users the ability to evaluate real estate or monitor tax obligations effectively.

How to check property taxes by address?

Property taxes in Miami County are based on the assessed value of the property, which is typically 35% of the market value, multiplied by local millage rates. Users can enter a property address in the auditor’s online search to view current and past tax amounts, payment history, due dates, and whether any balance is delinquent. This method ensures that homeowners, investors, and professionals can verify property taxes accurately and access official parcel-by-address tax records in a single, reliable location.

How often are records updated?

Property records in Miami County are updated regularly to maintain accuracy. Ownership changes appear after deed recording, property valuations are updated every three years during Ohio’s reappraisal cycle, and tax payment status is refreshed after each billing cycle. This ensures that a property address search always reflects the most current information on ownership, assessed values, property location, and tax obligations, allowing users to rely on official data for any decision-making.