A Miami County property search by parcel number gives the most accurate way to view official land and tax records for one exact property. This search uses a unique parcel PIN linked to a single record held by the county. Each parcel number connects directly to the land, not the owner’s name or street address. This method reduces errors caused by similar addresses or shared names. Many buyers and owners prefer this search for fast and clear results. The process stays simple and works well for quick property checks.

Each parcel number serves as a permanent property ID issued by the Miami County Ohio Auditor, and it remains unchanged even after a sale or transfer. A property parcel lookup provides assessor parcel number details directly from county records maintained by the auditor’s office. Users can review ownership information, assessed values, tax districts, and basic land parcel data all in one place. By using this fixed reference point, real estate research becomes more straightforward, helping individuals make informed decisions tied to Miami County property records.

What Is a Parcel Number in Miami County?

A parcel number in Miami County is a unique, permanent code assigned to each property by the county auditor. This assessor parcel number stays with the land even if the owner or address changes. The parcel number, often called a property ID, tax parcel number, or parcel PIN, works as the official identifier in county records. The Miami County Auditor assigns it at the time a parcel is created or split. So, it serves as the most reliable way to track property details across tax, ownership, and land records.

Each parcel number links directly to key data, such as:

- Owner name and mailing address

- Land use and zoning

- Market and assessed value

- Tax district and levy details

- Parcel map and boundary lines

Since the number never changes, it prevents mix-ups that can happen with street names or unit numbers. For that reason, a parcel PIN gives the clearest path to accurate land parcel info in Miami County.

How to Find Your Miami County Parcel Number

A Miami County parcel number can be found on official property records, such as tax bills, deeds, or through the county auditor’s online tools. This number is required for an accurate parcel ID search and reliable property parcel lookup.

Finding the correct parcel number saves time and prevents errors during property research. Several trusted sources make this process simple and quick.

Check the Property Tax Bill

Property tax bills list the parcel number near the owner’s name and mailing address. This number may appear as a parcel PIN, tax parcel number, or property ID. Both paper and online tax statements include this detail, making them a fast option.

Review Deed or Closing Documents

Deeds, settlement statements, and title records show the assessor’s parcel number used during ownership transfer. These documents stay accurate even after an address change, which helps confirm land parcel info.

Use the Miami County Auditor Website

The Miami County Auditor provides an official property search tool. Users can locate a parcel number by:

- Owner name

- Property address

- Interactive parcel map or GIS records

Once located, copy the full number exactly as shown.

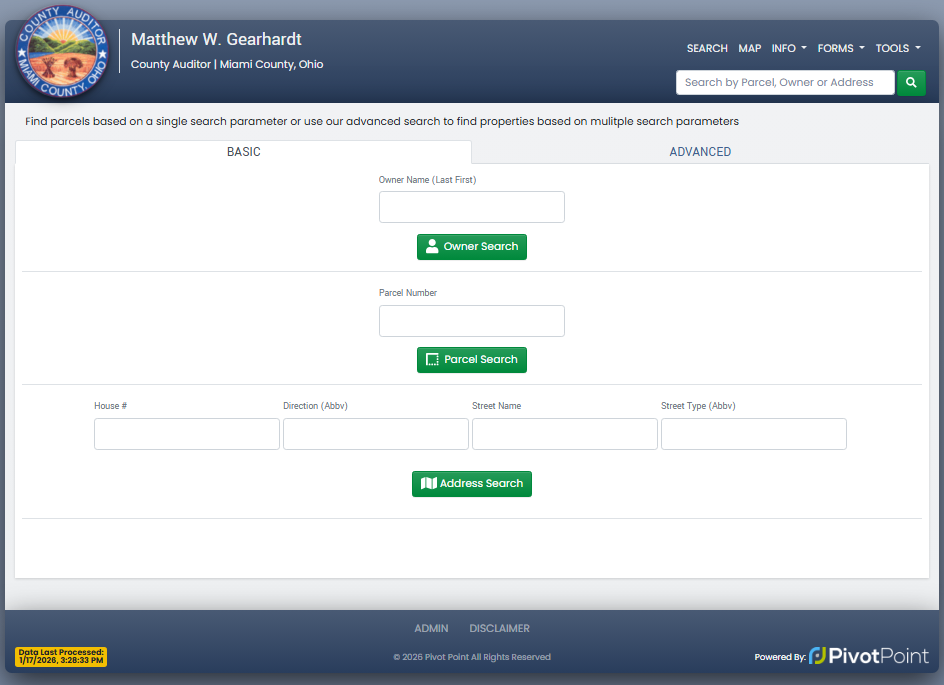

How to Perform a Miami County Property Search by Parcel Number

A Miami County property search by parcel number takes only a few minutes and gives the most precise property details available. By entering the correct parcel PIN into the county search tool, users https://www.miamicountyohioauditor.gov/Search can view ownership, value, tax, and land parcel info in one place.

Steps Parcel Number Lookup Process

- Open the Miami County Auditor’s property search page

The official Auditor website hosts the parcel number lookup tool, which is used for county property records. This is where the parcel PIN gets entered. - Select “Search by Parcel Number”

Choose the parcel number or parcel PIN option from the search type menu before entering any data. - Enter the full parcel number exactly as listed

Type the assessor parcel number without extra spaces or symbols. Many parcel IDs include letters and numbers, so accuracy matters. - Check formatting before submitting

Some parcel numbers require dashes or specific spacing. If a search returns no results, removing spaces often helps. - Click the search button and review the results

Property details usually appear within 1–2 minutes, including owner name, property ID, assessed value, tax district, and parcel map data.

What Information a Parcel Number Search Shows

A parcel number search provides a complete snapshot of a property’s official records. It delivers critical details, including ownership, value, and legal classification in Miami County.

Key information you can access through a parcel number search:

- Owner Name: Shows the full legal property owner as recorded with the Miami County Auditor, helping verify ownership and prevent confusion.

- Property Classification: Indicates whether the property is residential, commercial, agricultural, or vacant land, which is important for tax and zoning purposes.

- Market & Assessed Value: Displays the property’s estimated market value along with the assessed value used for tax calculations.

- Tax District: Identifies the local jurisdiction responsible for property taxes, including school district levies and millage rates.

- Sales History: Lists prior ownership, sale prices, and transaction dates, useful for market comparison or investment decisions.

- Parcel Map/GIS: Provides a visual map of property boundaries, lot dimensions, and neighboring parcels in an interactive format.

- Using land parcel info, property ID, and assessor parcel number together ensures accurate records for legal, financial, or planning purposes.

- This information makes a parcel number lookup the most reliable way to confirm ownership, evaluate property value, and review tax responsibilities.

Is Miami County Property Search by Parcel Number Free?

Yes, searching property records in Miami County by parcel number is completely free when done online. Residents and researchers can quickly view property tax records and ownership information through the Miami County Auditor website without any cost. The online property search tool allows users to enter a parcel number, owner name, or property address to access detailed land and tax information. This makes it a reliable resource for homeowners, buyers, or professionals who need official property details. Using the tool requires no registration, and results typically appear in just a few seconds. While the basic search is free, certain services may incur fees if official or certified documentation is needed. For example, printed copies, certified records, or GIS map prints may have small charges.

Below is a helpful breakdown of common paid services:

| Service | Typical Fee |

|---|---|

| Printed copies of records | Small per-page fee |

| Certified property records | Varies by document |

| GIS or parcel map prints | Varies by size/format |

| Title or legal research requests | Third-party fees apply |

Most searches for Miami County property tax records require no payment. The parcel number search ensures that users access accurate ownership details, assessed value, and tax district information without any cost. Using the official Miami County Auditor tools guarantees that the data is reliable, current, and legally recognized.

Common Forms Related to Parcel Number Searches

Property owners often need specific forms to manage their parcel records and property ID details accurately. These forms allow residents to update ownership information, appeal valuations, or claim exemptions efficiently.

When working with Miami County property records, several official forms are commonly used:

- Address Change Form: Property owners must submit this form to update their mailing address. Accurate contact information ensures tax notices and legal documents reach the correct recipient.

- Valuation Appeal (BOR Form): If an owner believes the assessed value of their property is incorrect, this form can be filed with the Board of Revision to request a reassessment.

- Homestead Exemption Application: This form provides eligible homeowners with property tax relief. It requires proof of residency and ownership for approval.

- Conveyance / Ownership Transfer Form: Used during property sales or inheritance, this form updates the county’s parcel records to reflect new ownership legally.

These forms are maintained by the Miami County Auditor and are often available online or at the Auditor’s office. Submitting the correct form with accurate property ID information ensures smooth processing and avoids delays. Keeping these documents organized helps property owners manage taxes, ownership records, and legal responsibilities efficiently.

The Property Taxes Using a Parcel Number

Property taxes in Miami County can be accurately calculated using a parcel number. This number connects directly to official property records, making property tax lookup simple and precise. Every property in the county has an assessed value, which is a percentage of its market value. In Miami County, this follows the 35% assessment rule, meaning the assessed value equals 35% of the property’s market value. For example, a home with a market value of $200,000 would have an assessed value of $70,000. This assessed value serves as the foundation for calculating annual property taxes.

Property taxes also depend on the tax district where the property is located. Each district applies its own millage rate, expressed in mills (thousandths of a dollar). A millage rate of 16.0 means $16 of tax per $1,000 of assessed value. The formula to estimate taxes is straightforward:

Estimated Tax = Assessed Value × Millage Rate ÷ 1,000

For instance:

- Assessed Value: $70,000

- Millage Rate: 16.0

- Estimated Annual Tax: $70,000 × 16 ÷ 1,000 = $1,120

Miami County Property Tax Rates by City, Township & Village

Miami County property tax rates vary depending on the city, township, or village where the property is located. These rates reflect local levies, school district taxes, and other municipal charges that impact the total property tax bill. Property owners can use land parcel info and parcel numbers to determine their exact tax rate. While general ranges exist, each property’s assessed value combined with the local tax rate produces its actual annual tax. Knowing the typical rates by area helps homeowners, buyers, and investors plan for tax obligations.

Estimated Property Tax Ranges in Miami County, Ohio

| Area Type | Location | Typical Effective Tax Rate |

|---|---|---|

| City | Troy | 1.45% – 1.75% |

| City | Piqua | 1.50% – 1.80% |

| City | Tipp City | 1.40% – 1.70% |

| City | Sidney | 1.35% – 1.65% |

| Township | Concord Township | 1.20% – 1.50% |

| Township | Monroe Township | 1.25% – 1.55% |

| Township | Newton Township | 1.30% – 1.60% |

| Township | Bethel Township | 1.35% – 1.65% |

| Village | Covington | 1.40% – 1.70% |

| Village | West Milton | 1.45% – 1.75% |

| Village | Casstown | 1.30% – 1.60% |

| Village | Pleasant Hill | 1.35% – 1.65% |

Why Parcel Number Search Is More Accurate Than Address Search

A parcel number search provides the most precise way to locate property records in Miami County. Unlike address searches, it directly links to official property parcel lookup records without risk of duplication or error. Every property in Miami County has a unique parcel ID, also called an assessor parcel number or property ID. This number stays constant even if the property’s street address changes due to renumbering, new construction, or subdivision. In contrast, addresses can be shared or updated, which sometimes leads to incorrect ownership records or incomplete tax information.

Using a parcel ID search ensures:

- Accuracy: Each search retrieves only the correct property details.

- Legal reliability: Official records, including deeds and tax information, match the parcel number exactly.

- Tax verification: Assessed values, tax districts, and payment history are all tied to the permanent parcel number.

Additionally, a parcel number provides access to comprehensive data, including:

- Property classification (residential, commercial, agricultural)

- Market and assessed values

- Owner and mailing information

- Parcel maps and dimensions

By focusing on the parcel number rather than an address, property buyers, investors, and officials can avoid confusion, prevent mistakes in property reporting, and confirm legal ownership quickly. For anyone performing a Miami County property search, this method delivers the most reliable results with minimal effort.

Common Problems When Searching by Parcel Number

Searching Miami County property records using a parcel PIN or assessor parcel number is usually straightforward, but users occasionally face errors. Most issues stem from formatting mistakes, outdated ownership records, or processing delays.

Incorrect Parcel PIN Entry

One common problem occurs when the parcel PIN is entered incorrectly. Even a missing digit or extra space can prevent results from appearing. Users should double-check the number against their property tax bill or deed, ensuring the exact format matches the Miami County Auditor’s records.

Outdated Ownership Information

Another frequent issue is ownership information not being up to date. Properties that recently changed hands may still show the previous owner in the system. In such cases, users can verify recent transfers with the County Recorder’s Office or check the most current assessor parcel number listings.

Processing Delays

Processing delays can also affect searches. While most parcel ID searches return results in minutes, certain updates, such as newly recorded deeds or changes in land parcel info, may take a few weeks to appear online. Users should allow 2–6 weeks for official updates and try alternative searches by owner name or property address if results are missing.

FAQs About Search Property by Parcel Number

Looking for property information in Miami County is easier with a parcel number. The following frequently asked questions explain how parcel searches, property IDs, and assessor numbers work, and how they help users access accurate land and tax records efficiently.

How can I perform a Miami County property search by parcel number?

A Miami County property search by parcel number allows users to access official property details quickly. By entering the parcel number in the Auditor’s property search tool, users can view ownership information, assessed and market value, tax district, and recent sales history. Parcel numbers, also called parcel PINs, provide more accuracy than address-based searches. This method reduces duplicate results and ensures legal records match the correct property. It is ideal for buyers, real estate professionals, and investors who need precise data.

What is a Parcel ID search, and how is it used?

A Parcel ID search uses the property’s unique identification number to locate official records. This number links directly to ownership information, assessed value, property classification, and GIS maps. Users can verify legal ownership and check land and building details efficiently. Parcel ID searches are especially helpful for property buyers, investors, and legal professionals. They provide accurate results without relying on sometimes-changing addresses.

What does an assessor’s parcel number show?

An assessor’s parcel number is a permanent identifier assigned to each property for tax and legal purposes. It appears on deeds, tax bills, and county records. Using this number, users can verify property classification, assessed and market values, tax district, and legal ownership. It ensures official records are correctly matched to the property. Assessor parcel numbers remain constant, making them the most reliable method for accurate property searches.

Can I perform a property tax lookup with a parcel number?

A property tax lookup by parcel number displays current and past tax amounts, payment history, and tax district information. Users can also confirm school district levies and local millage rates. This method reduces errors compared to address-based searches and ensures correct assessed values for calculations. Property tax lookups help homeowners plan payments or verify obligations. Using a parcel number ensures precise, official, and up-to-date information from the county.

What is a property parcel lookup, and why is it useful?

A property parcel lookup provides detailed information about land and buildings using the parcel number or property ID. It shows ownership, property type, assessed and market values, recent sales, and GIS maps. Users can verify legal ownership and review land parcel info quickly. This method is faster and more accurate than relying on addresses. Property parcel lookups are essential for homeowners, buyers, and investors seeking official county-verified details.