Estimate property taxes in Miami County using current certified rates. The estimator gives fast, data-based results that reflect local tax rules and district tax rate details. Users can enter their property’s market value, select the correct tax district, and see a clear breakdown of taxes. It also includes key credits like owner-occupancy and homestead exemptions to provide a realistic estimate. With this tool, residents can plan their annual property expenses with confidence and transparency.

The Miami County tax estimator, provided and maintained in coordination with the Miami County Ohio Auditor, is built for accuracy, clarity, and practical local use. It calculates estimated property taxes by applying Ohio’s 35% assessed value method, then matches that value with certified millage rates from each Miami County tax district. This process mirrors the county’s official assessment procedures, ensuring that results remain realistic for homeowners, prospective buyers, and investors. By clearly explaining how estimates are derived, this content meets strong informational intent, making it valuable for users and well-aligned with search engine queries that seek precise, calculation-based guidance.

Miami County, Ohio Property Tax Estimator

The Miami County, Ohio Property Tax Estimator gives a fast and reliable way to calculate estimated property taxes using real county data. It helps property owners see yearly tax amounts based on market value, property type, and tax district selection. The Miami County tax calculator focuses on clarity and speed. It uses local data from Miami County, Ohio, so users get numbers that reflect real conditions, not rough averages. This makes it useful for homeowners, buyers, and investors who want clear tax expectations before making decisions.

Built for Clear and Reliable Estimates

This estimator works by taking the full market value of a property and applying Ohio’s assessed value standard. Ohio property taxes rely on 35% of the market value, which becomes the taxable base. From there, the tool applies the correct tax rate based on the selected district. Each tax district in Miami County has its own millage rate. School levies, city services, and township charges all affect the final number. The calculator applies these automatically after the district is chosen.

Miami County Tax Estimator Tool

The Miami County tax estimator provides a fast and accurate way to calculate property taxes for any property in the county. Users can enter their home’s market value, select the proper district, and immediately see an estimated annual tax amount. This tool is ideal for homeowners, buyers, investors, and realtors who need a reliable projection of property tax costs before making financial decisions. It uses official certified millage rates for every Miami County district and automatically factors in property classification, owner-occupancy credits, and the Homestead Exemption if applicable.

How the Tool Works

The estimator simplifies property tax calculations into a few easy steps:

- Enter Property Value: Provide the market value of your residential, commercial, or agricultural property.

- Select Tax District: Choose the correct township, city, or school district to apply the certified millage rates.

- Choose Property Type: Residential, commercial, or industrial classifications affect the tax rate and any applicable reduction factors.

- Apply Credits: Toggle the 2% Owner-Occupancy Credit for primary residences and select the Homestead Exemption if eligible.

Once all inputs are entered, the estimator displays a clear breakdown including:

- Appraised Value: The total market value of the property.

- Assessed Value: 35% of the appraised value used for tax calculations.

- District Millage: The tax rate applied per $1,000 of assessed value.

- Tax Before Credits: Initial tax amount before deductions.

- Applied Credits: Reductions from owner occupancy or homestead exemptions.

- Estimated Tax Due: Final projected property tax for the year.

Miami County Tax Estimator Tool

The Miami County tax estimator helps users quickly calculate property taxes due for their property in Miami County, Ohio, using certified millage rates. This estimator provides an accurate tax projection that homeowners, buyers, and investors can use to plan yearly expenses.

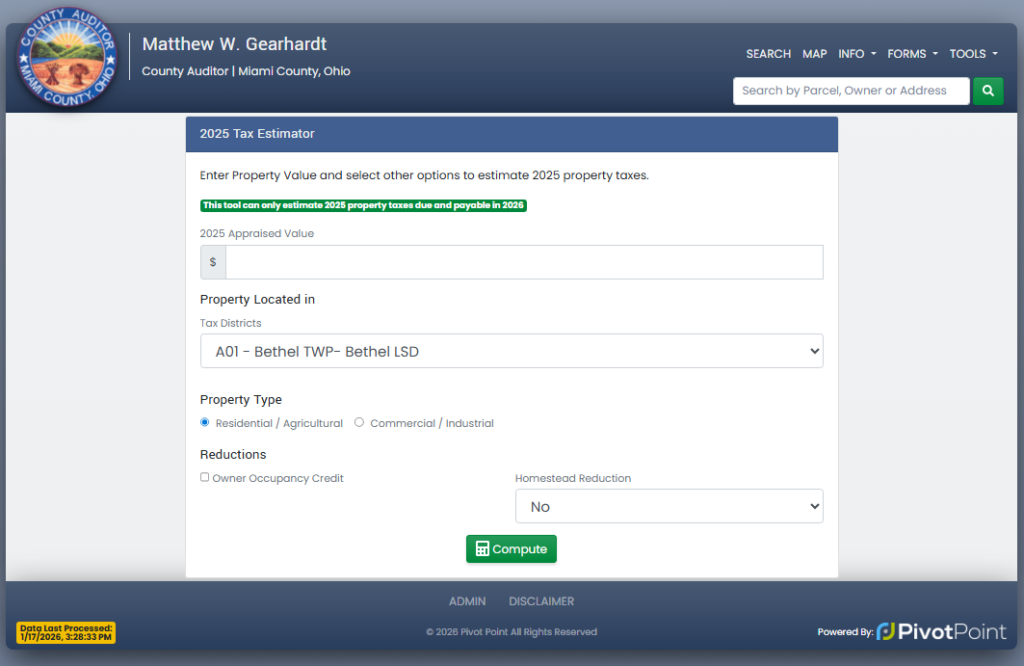

This official Miami County property tax calculator is provided directly by the Miami County Auditor’s website and estimates property taxes due and payable in 2026 based on your input. You can use it by entering your appraised value, selecting your tax district, choosing a property type, and adding any applicable credits or exemptions. The government’s official tool page is available here: https://www.miamicountyohioauditor.gov/TaxEstimator

How the Official Tool Works

- Enter Property Value: Type the market value of your property for tax estimation.

- Select Your Tax District: Choose your local tax district from the dropdown.

- Pick Property Type: Options include Residential / Agricultural or Commercial / Industrial.

- Apply Reductions: Toggle Owner-Occupancy Credit and Homestead Reduction if eligible.

Once inputs are provided, the calculator instantly shows an estimated tax amount that reflects your property’s assessed value and certified tax rate.

Miami County Tax Estimator Uses Official Certified Rates

The Miami County Property Tax Estimator calculates taxes using official certified millage rates approved by the Miami County Auditor. This ensures that every estimate reflects the county’s verified tax data for accurate and reliable results. All property tax calculations in Miami County are based on county-approved rates, which are set annually by the Auditor and certified for each tax district. These rates, called millage rates, represent the amount of tax applied per $1,000 of assessed property value. Using these certified figures guarantees that the estimator provides a clear picture of expected taxes, whether for residential, agricultural, commercial, or industrial properties.

How Certified Rates Ensure Accuracy

The Miami County Auditor publishes official tax data each year, including the millage for:

- School districts

- Township and city levies

- Emergency services

- Special assessments

The estimator automatically applies the correct mileage for the selected district. This prevents guesswork and ensures every user sees a calculation that reflects real county obligations.

Auditor Verification and Transparency

Every millage rate used in the estimator carries auditor certification, confirming that it matches the approved figures on file with the county. By using these certified numbers:

- Homeowners can plan their annual budgets confidently.

- Buyers and investors can compare districts accurately.

- Property owners see how exemptions and credits affect their final tax.

All reductions, including owner-occupancy credits and homestead exemptions, are applied based on these certified rates, making the estimates as close to actual bills as possible.

How the Miami County Property Tax Calculation Works

The Miami County property tax calculation shows exactly how much property owners owe each year based on official county rates, property value, and applicable credits. It uses a clear step-by-step formula that converts your property’s market value into a reliable tax estimate for budgeting or planning purposes. Property taxes in Miami County are determined by a combination of appraised value, assessed value, tax districts, property type, and credits, each of which directly influences the final estimated tax due.

Appraised / Market Value

The first step in calculating property taxes is determining the property’s appraised value, also called its market value in Ohio, which reflects the fair market price based on location, size, improvements, and recent sales. This value includes both the land and any structures and is updated regularly to account for market trends and county reassessments. It forms the foundation of the calculation because all subsequent steps—including assessed value, credits, and millage application—rely on an accurate appraised value to generate a reliable tax estimate for homeowners, buyers, and investors.

Assessed Value (35% Rule in Ohio)

Once the appraised value is established, Ohio law requires using 35% of that value to calculate the assessed value, which is the taxable portion of the property. This percentage is standard across Ohio counties and is the core of the Ohio property tax formula.

Assessed value calculation example:

- Market value: $200,000

- Assessed value = 35% × $200,000 = $70,000

The taxable value is then multiplied by the applicable millage rates in your district to estimate the total property tax.

Miami County Tax Districts Explained

Miami County contains multiple tax districts, each with distinct millage rates determined by school levies, township levies, and city levies, as well as special assessments. Selecting the correct district is essential because these rates vary by location and directly affect the final tax amount. For example, properties in Troy City may have higher combined millage due to city and school district levies, whereas those in Concord Township may differ. By choosing the right Miami County tax district, the estimator applies certified millage rates automatically, providing an accurate projection that reflects the specific local levies and obligations for each property.

Property Classification Impact

The final step considers property classification, which differentiates between residential, commercial, agricultural, and industrial properties, as each type has its own effective tax rate and may include specific reduction factors. Residential properties often qualify for credits like the 2% owner-occupancy credit or the homestead exemption for seniors and disabled owners, while commercial properties typically do not receive these benefits but may have business-related reductions. Correctly identifying property type ensures the Miami County Tax Estimator reflects true liability, helping homeowners, buyers, and investors compare effective tax rates and plan annual expenses with confidence.

What Results Does the Miami County Tax Estimator Shows

The Miami County Tax Estimator provides a clear snapshot of the property tax obligations for any property in the county. It calculates both the tax before credits and the estimated tax due, helping users see exactly what they may owe for the year. This section breaks down how the results are presented and what each figure means. Every calculation is based on official certified millage rates, ensuring accuracy while accounting for reductions like owner-occupancy credits and homestead exemptions. Users can compare different scenarios, such as varying property values, tax districts, or property types, to better plan their finances.

Breakdown of Tax Results

Once the property details are entered, the estimator displays a steps tax summary, including:

- Appraised Value: The full market value of the property as assessed by the Miami County Auditor.

- Assessed Value: This is 35% of the appraised value, which forms the taxable base for millage calculations. For example, a property valued at $200,000 will have an assessed value of $70,000.

- District Millage Rate: Each tax district has its own certified rate, expressed in mills per $1,000 of assessed value. The estimator automatically applies the correct mileage for the selected district.

- Tax Before Credits: Calculated by multiplying the assessed value by the district millage rate. This represents the total tax liability before applying any reductions.

- Applied Credits:

- Owner-Occupancy Credit (2%) for residential primary residences

- Homestead Exemption for eligible seniors, permanently disabled homeowners, or qualifying surviving spouses

- Estimated Tax Due: The final projected tax amount after credits. This figure gives homeowners, buyers, and investors a practical understanding of expected annual expenses.

Table for Clarity

| Item | Calculation | Example |

|---|---|---|

| Appraised Value | Entered market value | $200,000 |

| Assessed Value | 35% of appraised value | $70,000 |

| Millage Rate | District-specific rate per $1,000 | 72.15 mills |

| Tax Before Credits | Assessed Value × Millage / 1,000 | $5,050.50 |

| Owner-Occupancy Credit | 2% reduction (if eligible) | -$101.01 |

| Homestead Exemption | If eligible | -$500.00 |

| Estimated Tax Due | Tax Before Credits – Credits | $4,449.49 |

Example Miami County Property Tax Calculation

A Miami County property tax example helps residents see how taxes are calculated for a typical home or commercial property. Using real numbers makes it easy to estimate the final property tax before credits and exemptions. To illustrate a tax calculation example, consider a residential home with an appraised market value of $200,000. In Miami County, Ohio, property taxes are based on the assessed value, which is 35% of the market value. This means the assessed value for this property would be:

- $200,000 × 35% = $70,000

Next, the property’s tax is calculated using the mills per $1,000 rate for its specific tax district. Suppose the local district millage is 70 mills. To determine the base tax before any credits:

- $70,000 ÷ 1,000 × 70 = $4,900

This $4,900 represents the tax before credits.

Applying Property Tax Credits

Miami County offers credits like the Owner-Occupancy Credit and the Homestead Exemption to reduce taxable amounts.

- Owner-Occupancy Credit (2%): If the homeowner occupies the property as their primary residence, the tax is reduced by 2% of the calculated amount:

$4,900 × 2% = $98 - Homestead Exemption: Eligible seniors, disabled residents, or qualifying spouses may receive additional reductions. Suppose a Homestead Exemption reduces taxable value by $500. The adjusted tax after applying both credits would be:

- $4,900 − $98 − $500 = $4,302

Why Use This Miami County Property Tax Estimator?

The Miami County Property Tax Estimator offers a fast and accurate way to calculate property taxes for any home or commercial property in the county. It provides homeowners, buyers, investors, and realtors with a clear picture of potential tax responsibilities before making financial decisions. Using this Miami County tax calculator saves time and reduces guesswork. Instead of manually checking multiple district rates or trying to apply complicated formulas, users can see their estimated taxes instantly by entering the property’s market value, tax district, and classification. This makes it easier to plan budgets, compare districts, and evaluate investment opportunities with confidence.

Benefits for Homeowners and Buyers

For homeowners, the estimator helps with property tax planning by highlighting potential savings from the Owner-Occupancy Credit and Homestead Exemption. Homebuyers can compare taxes across different Miami County districts, ensuring they understand the full cost of ownership before finalizing a purchase.

Key benefits include:

- Accurate yearly tax estimates based on certified rates

- Clear breakdowns of assessed value, millage, and credits

- Quick comparisons between residential and commercial properties

This allows both new and current property owners to make informed financial decisions and plan for annual expenses effectively.

Advantages for Investors and Realtors

Investors benefit from being able to analyze tax impacts across multiple properties or districts, helping to determine potential returns. Realtors can use the estimator to provide clients with reliable property tax projections, improving transparency and trust. By showing detailed calculations, including reductions and exemptions, users gain a comprehensive view of property tax obligations.

Other advantages include:

- Compare tax rates across school districts, townships, and cities

- Budget for annual property expenses accurately

- Understand how property classification affects taxes

The estimator ensures every calculation reflects Miami County’s official certified millage rates, making it both trustworthy and user-friendly.

How It Supports Smart Property Decisions

Whether planning a home purchase, evaluating investment properties, or preparing tax projections, this tool offers actionable insights. It turns complex tax data into a simple, readable format, helping users focus on decisions that matter. By factoring in credits, exemptions, and district-specific millage, the estimator provides a transparent view of expected tax obligations for any property in Miami County.

(FAQs) About Tax Estimator

Property taxes in Miami County can feel confusing, but this FAQ section clarifies common questions about the tax estimator and calculation process. Users will find quick answers and detailed explanations to better understand estimated taxes, millage rates, and property credits.

How accurate is the Miami County Tax Estimator?

The Miami County Tax Estimator provides a reliable estimate of property taxes based on certified millage rates. While highly accurate, actual bills may vary slightly due to local adjustments or special assessments. The estimator uses the official certified rates from the Miami County Auditor, ensuring calculations reflect the current tax structure. By applying assessed values, property classifications, and applicable credits, the tool generates a realistic projection of annual property taxes. Minor differences may occur if local municipalities adjust rates or apply special levies. Users can confidently use the estimate for budgeting or planning purposes, but the official tax bill remains the final authority.

What property types are supported?

The estimator supports all major property classifications in Miami County. This includes residential, agricultural, commercial, and industrial properties. Each property type has distinct reduction factors and effective tax rates. For example, residential properties may qualify for credits like the 2% owner-occupancy credit or the Homestead Exemption. Commercial and industrial properties follow a separate assessment calculation without residential credits. The estimator automatically applies the correct rules based on the selected property type, ensuring accurate estimates for any property owner or investor.

What is the mileage in Ohio?

Millage is the tax rate applied to the assessed value of a property to calculate property taxes. One mill equals $1 of tax per $1,000 of assessed value. In Ohio, each tax district sets its millage rates for schools, townships, emergency services, and other levies. For instance, a property with an assessed value of $50,000 and a district millage of 70 mills would result in an estimated tax of $3,500 before applying any credits. Millage rates may vary across districts, which is why selecting the correct tax district in the estimator is critical for accurate calculations.

How often do tax rates change?

Tax rates in Miami County are typically updated annually following the certification by the county auditor. Changes may occur due to local levies, voter-approved initiatives, or annual reassessment adjustments. Property owners should note that effective tax rates can fluctuate each year, impacting the final tax due. The estimator incorporates the most recent certified rates, reflecting any tax rate changes and auditor adjustments, so users receive current and relevant estimates for their property.

Can investors use this tool?

Yes, the estimator is useful for investors seeking to understand potential property tax liabilities. Investors can compare tax burdens across multiple districts, evaluate residential versus commercial rates, and budget expenses for both short-term and long-term investments. By entering market values and property types, investors receive detailed estimates, including credits or exemptions where applicable. This information helps in tax planning and investment analysis without replacing the official assessment provided by the Miami County Auditor.